Definition of Interest Rate

An interest rate is the percentage yield on a financial security or asset such as a loan, bond or savings deposit. A variety of interest rates exist in the economy because of differences in the risk, liquidity and maturity of various financial instruments or assets.

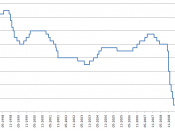

Different Types Interest Rates (% per annum)

Bank Current Deposit (at call) - 0.00%, June 2005

Cash Rate Target - 5.50% (+0.25%), 2nd March 2005

Banks Fixed Deposit Rate $5000 to $100,000 (5 years) - 4.75%, June 2005

Finance Company Debentures (3 years) - 5.40%, June 2005

Large Business Overdraft Rate (3 year variable) - 9.10%, June 2005

Small Business Overdraft Rate (3 year variable) - 9.60%, June 2005

The Determinants of Interest Rates

Risk refers to the ability of the borrower to repay the lender the amount borrowed. The risk and reward principle states that the higher the risk the higher the return or interest rate.

Conversely the lower the risk involved the lower the return or interest paid to the lender.

Eg: Debentures are loans to companies backed by company's assets whereas company notes are not. Debentures notes therefore carry lower interest rates than company notes as they are more secure by being backed by company assets.

Liquidity refers to the case with which financial instruments or assets can be converted into cash. Usually the higher the risk involved in lending funds the higher the interest rate demanded by the lender to cover the added risk. Similarly the less liquid a financial instrument the higher the interest rate that has to be offered by the borrower to induce the lender to lend funds.

Eg: Government bonds and company debentures and notes - A 1 year government bond with a 5% interest rate reflects minimal risk and reasonable liquidity since...