IntroductionUsing the following information it is the intent of this paper to show the different effects on Return of Equity, Net working capital and Current Ratios as they apply to 3 different short-term financing policies. This paper will also address the profitability and risks trade-offs of each of the 3 financing policies. In order to achieve the sort after data a balance sheet and income statement will be formulated using the financial information provided and certain financial formulas used to obtain the values needed to complete the Balance sheet and Income statement.

Financial information and formulasCurrent Assets = 30M, Fixed Assets = 35M, EBIT = 6M, Sales = 60M,Total Liability = equity + sum of debt (Current Liabilities/short-term debt and Long - term debt65,000,000 = 40,000,000 + 25,000,000 amount to be divided amongst short and long term debtCurrent Liability = amount of short-term debtLong-term Debt = $25,000,000 - short-term debtExpected rate of return on stockholders' equity (for each of the stated amount of short-term debt financing policies)Financial Policy In mil.

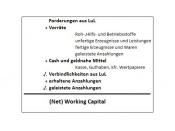

LTD (%)STD (%)Aggressive(large amount of short-term debt) $24,000,0008.55.5BALANCE SHEET = AggressiveC/A$30 C/LX = 24,000,000F/A$35LTDY- 1,000,000EQUITY$40T/A$65T/L$65Income statement Aggressive Financial PolicyEBIT$ 6,000,000InterestSum of C/L percentage and LTD percentage5.5% * C/L = 5.5%* 24,000,000= 13200008.5% * LTD = 8.5%* 1,000,000= 850001320000 + 85,000 = 1,405,000EBTEBIT - Interest6,000,000 - 1,405,000 = 4595000Taxes (40%)Tax percent x EBT40% * 4595000= 1838000Net IncomeEBT - Taxes4595000-1838000= $ 2,757,000Equity$ 40,000,000Return on EquityNet income / equityNet income divided by equity =2757000/ 40,000,000 =6.89%= ROEFinancial Policy In mil. LTD (%)STD (%)Moderate(moderate amount of short-term debt) $18,000,0008.05.0BALANCE SHEET = moderateC/A$30 C/LX = 18,000,000F/A$35LTDY- 7,000,000EQUITY$40T/A$65T/L$65Income statement Moderate Financial PolicyEBIT$ 6,000,000InterestSum of C/L percentage and LTD percentage5.0% * C/L = 5.0%* 18,000,000= $900,0008.0% * LTD = 8.0%* 7,000,000= $560,000$900,000 + $560,000 = $1,460,000EBTEBIT - Interest$6,000,000 - $1,460,000 = $4,540,000Taxes (40%)Tax percent x EBT40% *...