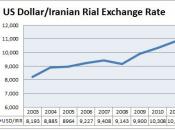

Since the inception of a floating currency exchange rate system, the Australian dollar has declined by over 30% and as a result many economist have warranted the return of the fixed exchange rate. But is it really worth it?

To see which system suits Australia best, we need to understand what the difference is between these two methods.

So what is a floating exchange rate system? Do you know...

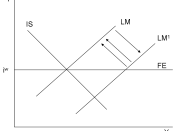

A free floating exchange rate is one where the value of the currency is determined solely by market demand and supply within the foreign exchange market. For example, the diagram above we see the effects of a rise in demand for the Australian dollar, causing an appreciation in its value.

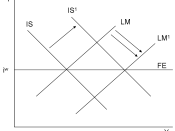

On the other hand, a fixed exchange rate, is one where there is commitment to a single fixed exchange rate. Prior to December 1983, the Reserve Bank pegged the Australia dollar to numerous currencies and acted each day to clear the foreign exchange market of any excess demand for or supply of Australian dollars, thus allowing the dollar to stay at a fixed rate.

A free floating exchange rate as I said is one where the value of currency is determines solely by supply and demand. Factors that influence the long term value of this type of exchange rate include- changes in the terms of trade, particularly commodity prices, a rise in trade leads to arise in the exchange rate. Secondly, changes in relative productivity levels, faster productivity growth leads to exchange rate appreciation. Finally, changes in interest rate differentials, high interest rates in Australia lead to higher exchange rate levels. However, the short term value can be altered my marked psychology, for example on the 5th of may 1998, incorrect rumours began to circulate in New York that...