Alternatives to Social Security

One proposed solution to the problems of the current pay as you go plan is to impose a system that would privatize the contributions of individuals (Aaron, 1999). The plan presented would be to shrink Social Security by enough to permit part of the payroll tax to be put into individual accounts, and let individuals control the accumulation until they reached retirement age. Several different ideas for privatization have been introduced to the government, varying in the amount of privatization, but the focus of most of these still relies heavily on giving individuals the freedom to explore different investment options such as mutual funds, individual stocks, treasury notes, and other choices. These investment options would enable the individual to diversify his or her account accordingly to their level of risk.

Proponents of privatization believe that the plan would have the following outcomes: a greater return on investment compared to the current system, an increase in national savings, and the plan would not require tax increases or benefit cuts.

The main argument that many make for greater returns is often accompanied with a reference to the Chilean privatization of social security. There are a variety of economic and political questions about this sort of proposal. Chile privatized its social security system in 1981, beginning with a slow phase-out of its existing system. Workers in Chile must save 10 percent of their earnings in individual mutual fund accounts (Ferrara, 1995). They also pay for survivor and disability insurance, and for the costs and profits of the mutual funds. On average, they pay 13 percent of earnings in order to save 10 percent and have this insurance. The Chilean economy has grown quite well since 1981, although not without some setbacks.

Before being allured by the advantages of privatization,

Social Security

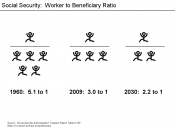

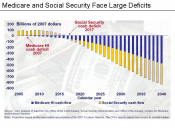

Yours is a good essay about a controversial issue which is increasingly in the news. With so many aging baby boomers retiring in the near future, and with a relatively smaller pool of workers to support Social Security, some changes to the system seem inevitable. It is not in the best interests of anybody for the system to go bankrupt and modifications now may make unnecessary more drastic changes later on. Having long been called the third rail of politics, Social Security has been something politicians have traditionally been unwilling to touch. However, the entire system may be in jeopardy unless reforms are instituted in order to save an important safety net for the retired who paid into Social Security all of their working lives.

7 out of 8 people found this comment useful.