Introduction

East Asia has been developed rapidly and created remarkable economic growth since 1970's. Multinational enterprises (MNEs) believe that investment in Asia can reduce costs and enlarge their markets worldwide because of cheaper labors and bigger opportunities. Taiwan is a country located in South Pacific region. It is one of the most developed countries of this region and is characterized by advanced technology and heavily relying on international trade. It is placed in the central of sea roads between North Asia and South Asia as well as near China. Its vital location offers MNEs great opportunities to wild expand businesses to other markets. Moreover, local government has eager to change regulations, decrease taxes, interest rates and improved infrastructures in order to lure more FDI and create a better environment for investment.

As liberalization and internationalization are the trends, Taiwanese government loosed restriction to allow foreign insurers set up branches in Taiwan even though it forbad Non-American insurance companies established in early 1980s.

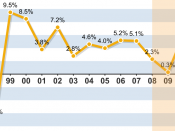

According to the survey by The Non-Life Insurance Association of R.O.C (2002), the written premium rate of general insurance was growing from 4.46% to 11.67% from 1998 to 2002 as well as premium income of life insurance was increase from 12.2 to 22% since 1999 based on the statistics of Life Insurance Association of R.O.C (2002). It can be said that insurance industry has space to growth as well as it can be expected bigger premium revenue in the future because of premium adjustment and compulsory insurances.

This report will state the advantages and disadvantages of macro-environment and the current situation of Taiwan's insurance industry. In addition, it will indicate what is the most appropriate market servicing strategy for Hong Leong group to enter the market and what are the approaches using presently by insurers for business practices...