When taxation is mention, eyebrows are raise, not just here in the United States but in mostcountries globally, especially those countries of which participate in international trading ofgood. Taxation is definitely an involuntary fee paid to the government from individuals withbusiness or private citizens. Taxation has become a hot discussion in the theories of economistand even in political parties. Taxation has three legitimate legal divisions, which is the local,state and the federal taxation of any good.

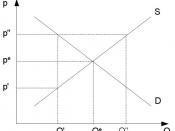

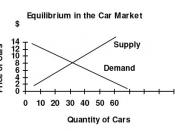

Local taxation is not levied on producers as it levies more on consumers. Most local taxComes from the property of resident citizens' p. Sales and income tax is included. SomeStates here in the United States collects not just from residents but also from non-residents whoworks in that city. Less is demanded due to any increased that is made through local taxation assuppliers may not be able to make sufficient quantity as the cost may be to high.

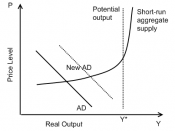

With the quantitydemand down the equilibrium would be increased. Tobacco or alcohol are two common goods wheretaxes are high mainly to reduce the usage of the product but also for revenue. Looking at the impositionof the price ceiling or floor on a product like sugar. The price floor on this is in subsidies so if the priceis above the price floor there will be no real effect as the market is already in demand. The sugar programis essentially a producer cartel run out of Washington. The Agriculture Department operates a complexloan program to guarantee sugar growers certain prices, which it enforces with import barriers anddomestic production controls (Edwards, 2007).

State taxation flows from real estates, sales, and excise tax. Hotel rooms are a good example, astaxpayers do not vote in this jurisdiction to have it levied. So in this case the producers is more levied onstate tax...