E5-5 (Preparation of a Corrected Balance Sheet)Uhura Company has decided to expand its operations. The bookkeeper recently completed the balance sheet presented below in order to obtain additional funds for expansion.

InstructionsPrepare a revised balance sheet given the available information. Assume that the accumulated depreciation balance for the buildings is $160,000 and for the office equipment, $105,000. The allowance for doubtful accounts has a balance of $17,000. The pension obligation is considered a long-term liability.

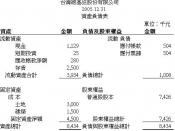

Uhura CompanyBalance Sheet31-Dec-07AssetsCurrent assetsCash $230,000Trading securitiesÃÂat fair value $120,000Accounts receivable $357,000Less: Allowance for doubtfulaccounts $17,000 $340,000Inventories, at lower of averagecost or market $401,000Prepaid expenses 12,000Total current assets $1,103,000Long-term investmentsLand held for future use $175,000Cash surrender value of lifeinsurance 90,000$265,000Property, plant, and equipmentBuilding $730,000Less: Accum. depr.ÃÂbuilding 160,000$570,000Office equipment $265,000Less: Accum. depr.ÃÂofficeequipment 105,000160,000730,000Intangible assetsGoodwill 80,000Total assets $2,178,000Liabilities and StockholdersÃÂ EquityCurrent liabilitiesAccounts payable $135,000Notes payable (due next year) 125,000Rent payable 49,000Total current liabilities $309,000Long-term liabilitiesBonds payable $500,000Add: Premium on bonds payable 53,000$553,000Pension obligation 82,000635,000Total liabilities 944,000StockholdersÃÂ equityCommon stock, $1 par, authorized400,000 shares, issued 290,000shares 290,000Additional paid-in capital 160,000450,000Retained earnings 784000Total stockholdersÃÂ equity 1,234,000Total liabilities and stock-holdersÃÂ equity $2,178,000E5-12 (Preparation of a Balance SheetPresented below is the trial balance of John Nalezny Corporation at December 31, 2007.

InstructionsPrepare a balance sheet at December 31, 2007, for John Nalezny Corporation. Ignore income taxes.

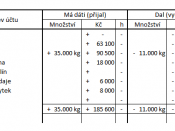

John Nalezny CorporationBalance Sheet31-Dec-07AssetsCurrent assetsCash $197,000Trading securities (at fair value)$153,000Accounts receivable $435,000Less: Allowance for doubtfulaccounts 25,000410,000Inventories 597,000Total current assets 1,357,000Long-term investmentsInvestments in bonds $299,000Investments in stocks 277,000Total long-term investments 576,000Property, plant, and equipmentLand $260,000Buildings 1,040,000Less: Accum. depreciation -152,000$888,000Equipment $600,000Less: Accum. depreciation -60,000540,000Total property, plant, andequipment 1,688,000Intangible assetsFranchise $160,000Patent 195,000Total intangible assets 355,000Total assets $3,976,000Liabilities and StockholdersÃÂ EquityCurrent liabilitiesAccounts payable $455,000Short-term notes payable 90,000Dividends payable $136,000Accrued liabilities 96,000Total current liabilities $777,000Long-term debtLong-term notes payable $900,000Bonds payable 1,000,000Total long-term liabilities 1,900,000Total liabilities...