1.) INTRODUCTION.

Managing financial risk is an important aspect of any financial institution. Financial disasters have proved that millions of dollars can be lost through poor financial management and supervision of financial risks. A financial manager is not only interested in the returns from the investments in a market but also the possible extreme and abnormal returns that seem possible. Without a careful analysis of the potential danger, the investment could cause catastrophical consequence when a shock occurs. With the experience of recent failure of large financial institutions such as the Barings Bank, sufficient risks control measures are clearly essential and the regulators have started to set restrictions on limiting the exposure to market risks. Value at Risk context says that precise prediction of the probability of an extreme movement in the value of a portfolio is essential for both risk management and regulatory purposes. Value at risk has so far been the most popular in determining financial risk in financial institutions and most risk managers feel that it could have prevented financial disasters like Barings, Orange County and Sumitomo.

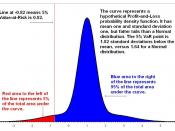

The Value at risk was developed in response to financial disasters of the 1990s and obtained an increasingly important role in market risk management. Value at risk is a statistical measure of potential loss from an unlikely or adverse event in a normal market environment According to (Gencay. R,) "The Value at risk summarizes the worst loss over a target horizon with a given level of confidence. It is a popular approach because it provides a single quantity that summarizes the overall market risk faced by an institution or an individual investor". To be presice VaR is the maximum expected loss over a given horizon period at a given level of confidence. Investors are mostly concerned on how much money...