Value at Risk

Contents:

Introtuction to Value at Risk pag 2

Methodologies for Measuring Risk pag 4

Conclusions pag 15

References pag 16

1. Introduction to Value at Risk:

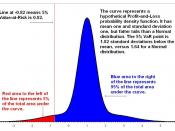

Risk can be defined as the volatility of unexpected outcomes, generally the value of assets or liabilities of interest. Firms are exposed to various types of risks, which can be broadly classified into business and nonbusiness risks.

Business risks are thouse which the corporation willingly assumes to create a competitive advantage and add value for shareholders. Business, or operating, risk pertains to the product market in which a firm operates and includes technological innovations, product design, and marketing. Operating leverage, involving the degree of fixed versus variable costs, is also lergely a choise variable. Judicious exposure tobusiness risk is a also "core competency" of all business activity. Business activity also include exposure to macroeconomic risks, which result from economic cycles, or fluctuations in incomes in monetary policies.

Other risks, over which firms have no control, can be grouped in to nonbusiness risks. These include strategic risks which result from fundamental shifts in the economy or political enviroment.

Finally, financial risks can be difined as thouse which relate to posible losses in financial markets, such as losses due to interest rate movements or defaults on financial obligations. Exposure to financial risks can be optimized carefully so that firms can concetrate on what they do best-manage exposure to business risks.

VaR traces its roots to the infamous financial disasters of the early 1990s that engulfed Orange Country, Barings, Metallgedellschaft, Daiwa, and so many others. The common lesson of these disasters is that billions of dollars can be lost because of poor supervision and management of financial risks. Spurred into action, financial institutions and regulators turnet to value at risk, an easy-to understand...