Implied volatility refers to the market expectations of share price volatility implied by observed option prices. Implied volatility is ascertained by reversing option pricing models. Instead of calculating the theoretical option price using the stock price, strike price, expected volatility, time to expiry, interest rate and expected dividend yield, the observed option price becomes an input and the expected volatility the output. The method is to find the level of expected volatility that is consistent with an observed option price. The objective becomes one of finding the value of expected volatility that generates a theoretical option price equal to the observed option price.

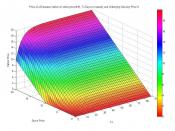

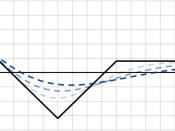

Unfortunately, the Black-Scholes model cannot be rearranged to provide an analytical solution for expected share price volatility. Instead, a numerical method must be employed. This involves an iterative search process. This can be likened to a trial-and-error process in which various values of expected volatility are put into the model and the resulting theoretical option values are compared with the observed option price.

Progressively the theoretical option price gets closer to the actual price. Eventually the theoretical price equals the observed option price, and the inputted value of expected volatility at that stage is the implied volatility.

For example, it may be that the observed option price is 5. The first step might be to input an expected share price volatility value of 20% p.a. into the Black-Scholes model. If this gives a theoretical option price of less than 5, then a higher expected volatility is tried. It may be that a volatility of 25% produces a theoretical option price of 5.5. This tells us that the implied volatility lies between 20% and 25% p.a. The next step may be to take an intermediate value such as 22.5%. If this produces a fair option price less...