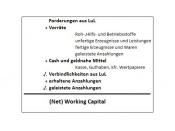

Working capital management is an integral part of business management. Working capital consists of a company's current assets and current liabilities. Working capital management is the management of cash, accounts receivable, inventories, accounts payable and short-term investments. All of these items comprise the heart of an organization.

Cash is king. Cash flow is the life of a company. Managing cash flow means controlling the collection, disbursement, and investment of cash. When it comes to managing working capital, time is money. Business managers must consider collection time and procedures, disbursement float, positive uses for idle cash including holding versus investing, and credit policies.

Proper inventory management can make or break a company. For many businesses, the inventory is a major investment. There are several different ways to manage inventory, including the ABC approach, the economic order quantity model, and derived-demand. Since inventory control ties into so many aspects of the business, including sales and collections, management must understand the importance of implementing optimal inventory procedures.

Mismanagement of inventory can result not only in the company's increase costs but in management's loss of employment. By neglecting the inventory control at his company, the CEO of Gillette company allowed the receivables period to grow to 106 days, resulting in a 50 drop in stock value and the loss of his job.

According to Andrew Harris, one company that understands the concept of working capital management is Bank of America. Harris states, "According to the Chief Financial Officer, the key ... is straightforward: to ensure the organization is able to fund the difference between short-term assets and short-term liabilities" (2005, para. 1).

Working capital management is a very important part of the current business environment. Successful working capital management can reduce costs, utilize inventory, raise profits, and increase shareholder value.