If we look at a reporting entity's balance sheet we will see a total given for all the entity's assets (this is a requirement of AASB101). This aggregate total is derived by adding together the various classes of current and non-current assets. Do you think it is appropriate that the various classes of assets are simply added together, even though they have probably been measured on a number of quite different measurements bases?INTRODUCTIONAASB requires the reporting entities to include balance sheet in their annual report. The objective of balance sheet is to provide information for internal and external users. Internal users like managers, owners can use the information in the balance sheet to know about their financial position at the current time and to evaluate how they can go forward in the future. Internal users are interested to know the total net assets the entity has at the current time.

External users like creditors, suppliers etc are willing to know how much the total value of the net assets is at the moment. They want to know the size of the business, whether it is reliable or not, whether the investment in the entity would be profitable or not.

Therefore relevance and reliability are must considerations when preparing a balance sheet.

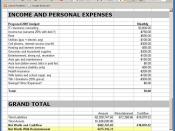

According to ACT department of Treasury, when a balance sheet is presented, it should contain subtotal for all the assets, liabilities and other particulars. (Retrieved on April 14, 2009 from the ACT Department of Treasuryhttp://www.treasury.act.gov.au/). This is to make sure that value of total current assets and total non-current assets can be observed very easily. This is in alignment with the pro regulation perspective where free-riders get have the access to financial information of reporting entities for free.

MEASUREMENT OF VARIOUS CLASSES OF ASSETSAsset in balance sheet...