Revenue Recognition PrincipleBy matching revenues with expenses the accrual concept became the cornerstone of accounting. By comparing cash with the cost of generating it an investor can develop an understanding for the profitability of a business. There are multiple ways to recognize revenue within Generally Accepted Accounting Principles (GAAP). Even though economic reality is the same, the financial statements may look drastically different depending on which method is chosen.

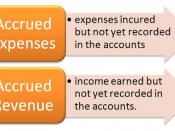

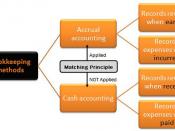

In accrual basis accounting an attempt is made to record the effects of transactions in the period in which they occur, rather than in the period in which cash is paid or received by a business. To properly determine net income under accrual basis accounting, revenues and expenses must be assigned to the appropriate accounting period. The revenue recognition and matching principles provide the basis for determining net income under accrual basis accounting.

The revenue recognition principle requires firms to recognize revenues when earned.

Typically this is when a service has been provided, or when goods are delivered. The matching principle attempts to match expenses with the revenues they produce. As a result, expenses are recorded in the same period as the revenues they generated.

While the revenue recognition and matching principles are rather straight forward, their application is often subject to seemingly arbitrary rules and requires the use of estimates(Cooper, Lyman, 2002).

Cash basis accounting is a method of bookkeeping that records financial events based on cash flows and cash position. Revenue is recognized when cash is received and expenses are recognized when cash is paid. In cash-basis accounting, revenues and expenses are also called cash receipts and cash payments.

Cash-basis accounting does not recognize promises to pay or expectations to receive money or service in the future, such as, prepaid payables and receivables, and prepared expenses. This is simpler...