Inflation is a sustained increase in the general price level over time within an economy. It is regarded as an economic problem as it leads to a fall in the value of money or real purchasing power. Inflation is caused by demand and supply pressures, notably demand inflation, cost inflation, imported inflation and inflationary expectations. Coupled with the many negative effects that Inflation burdens on the Australian economy, the government sets about using a variety of macroeconomic and microeconomic policies to control the level of inflation within the economy. Through the continual conduct of various policies by the Government and RBA, underlying inflation had been kept at about 2.5% in 2002, within the target range of 2-3% after being between 6-10% in the 1980's.

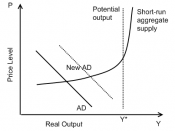

One cause of inflation within the economy is Demand inflation or otherwise known as Demand pull inflation. This is where aggregate demand exceeds Aggregate supply, causing inflation to occur as supply is not being able to meet the demand within the economy.

The main causes of demand pull inflation is excessive growth in any of the major components of AD (AD= C+I+G+X-M). Increased demand leading to inflation may have been caused by increases in consumption expenditure é, because of â confidence, â wages, tax cuts or falls in interest rates. Increases in investment spending may have been caused by tax cuts or increased depreciation allowances as outlined in the 2006 budget, which increases investment and causes demand pull inflation to occur. Government expenditure may increase due to a rise in Government revenue because of tax revenue, allowing the government to pursue an expansionary policy within the Australian economy. Increases in export income (X-M), may have been caused by higher investment and consumption within the domestic, causing excessive demand to occur and inflation to arise.

Demand pull inflation is demonstrated in fig 9.4, shows where due to increases in real GDP from GDP1 to GDP2, demand exceeds supply, causing the price level of goods rise, causing an inflationary gap to occur at point cd on the graph.

The second type of inflation, cost inflation, occurs when Aggregate Supply falls within an economy, leading inflation to occur. The fall in aggregate supply is caused by higher wage rates not related to productivity, â price of raw materials, government changes within the economy and â interest rates makes production more expensive thus leading to AS falling. Cost Push inflation is exemplified in figure 9.5. This shows a decrease in AS will shift the aggregate supply left to AS1, causing a new equilibrium at a higher price level of P1 to occur, and a lower output level of GDP2. The economy experiences a contraction, and due to AS falling, the price of goods rises causing Inflation to occur.

The third type cause of inflation is imported inflation, where inflation occurs because of a deficiency of imports into Australia. This makes domestically prices more expensive, as due to a lack of imports or the higher prices of imports, there is decreased competition causing inflation to occur. Causes of imported inflation may include a depreciation of the exchange rate, causing PP of the $A to fall and leading to the higher cost of imports. From 1998-2000, when the Australian dollar started to appreciate once again, as shown in this extract it caused inflation to fall once again. The fourth cause of inflation, inflationary expectations, underlines all of these major causes of inflation. When demand pull and cost push inflation work together an economy can experience a wage/price spiral, where wages rise in anticipation of the higher price of goods, and prices rise in anticipation of the cost of higher wages being passed on to the consumer. Inflationary expectations act as a trigger for wage increases and for price setters to increase prices. In the short term, denoted in figure 9.6, there is a tradeoff between inflation and unemployment (Higher inflation associated with lower levels of unemployment and vice versa).

However in the long run the tradeoff between unemployment and inflation disappears as workers increase there wage demands as inflation increases, and thus due to firms having to pay higher wages they cut back on labour keeping unemployment at the same level.

To control the rate of inflation and counter the causes associated, the government uses a variety of macroeconomic policies (relating to the economy as a whole) and microeconomic polices. The main macroeconomic policy, as seen by the RBA's motive to raise the cash rate in May 2006, is the use of monetary policy. The Reserve Bank of Australia may tighten monetary policy through an increase in the official cash rate. Through this increase in the official cash rate this will cause AD to dampen, thus Demand pull inflation will be overhauled as the major components of AD( AD= C+G + I + X-M), will contract. Through the tightening of monetary policy, real incomes will fall and the cost borrowing will increase, causing inflation to fall as AD within the economic contracts. The lifting of the cash rate to 5.75% in May 2006, was seen to control the rate of inflation so it may stay at the band target of 2-3%. The Government may also use a contractionary fiscal policy to stabilize demand pull inflation. A contractionary fiscal policy through an increase in taxation or reduced government expenditure will also cause AD to fall within the economy, causing inflation to fall. Thus it can be seen that to counter Demand Pull inflation, an effective macroeconomic policy will allow the government to control the rate of inflation within the Australian economy.

Microeconomic policies may also be used by the government to control cost push inflation (supply side) within an economy. One policy that may be used is taxation reform, in removing indirect taxes so that firms are more competitive, reducing inflation. As well, the government as it did in 1996, may deregulate the labour market to increase levels of competition and lower prices. Through the introduction of the Workplace relations act in 1996, the Government set about increasing competition so that inflation may be contained. Another policy that may be used is tariff reform, where protectionist policies may be relaxed to increase imports and competition to contain inflation within an economy. Another policy used to contain inflation was the introduction of the National Competition policy, to promote competitive conduct rules in markets. These policies set about increasing AS, so that inflationary pressures may not arise as a result of a deficiency in Supply. These policies lead to â productivity, â technologies, â education, , increased proficiency and increase in competition, which will intern combats inflation within an economy.

Therefore it can be seen that through the use of various macroeconomic policies, the government may control the causes and effects of inflation within an economy.