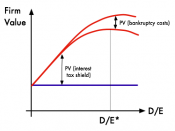

Achieving the right balance of debt to equity plays an important role for a company to achieve a stable capital structure. The Weighted Average Cost of Capital (WACC) helps a company to find the appropriate proportion of debt and equity and provides the overall cost of capital for the company. (Financial Analysis, 2007). There is no "one size fits all" approach to applying WACC. The most appropriate decision can change with the situation, and a drastic modification of the debt-equity mix could be the only option for a company.

scenario three years ago, the El Café began operating in a mall in Nicollett Mall, Minneaoplis, Minnesota, and became a very popular coffee shop. The café had a relaxed atmosphere in which their varied customer base enjoyed as well as their interesting blends of coffee. The café has become profitable since opening three years ago and the owner is contemplating expanding the business into a chain of coffee shops within the city.

Several issues are being faced by the owner in making the decision to expand with a few decisions being impacted by the involvement of the owner's rich uncle. The owner must find the best way to expand the business, maintain a reasonable debt-to-equity ratio while maximizing WACC, and obtain appropriate funding to complete the expansion. This all must be done while still maintaining a profitable business, avoiding bankruptcy or a takeover.

Recommended SolutionsThe first scenario involves deciding the optimal debt-equity mix to finance the expansion, with WACC as the benchmark. (Financial Analysis, 2007). The owner must generate an estimated $400,000 if two more shops are to be opened as planned. The state governor announced that small businesses in the special economic zone will incur zero taxes and can obtain low interest loans. The owner's uncle...