New Venture Creation February 23, 2000 Submitted to: Brent Mainprize Fax International, Inc.

Description of the Business Opportunity Is it a New Combination? The product offering provided by Fax International is meeting the excess demand by establishing relationships and utilizing existing technology to meet the needs of a new market. Under the Five Areas of Discovery the company would be "opening a new market" by providing facsimile services to Japan and Europe. Although, since the technology is simply and improvement over an existing service offered the venture is ranked as medium in this category which could be seen as a potential weakness.

Is There a Product-Market Match? The Japanese telecommunications market is completely different than the US market and quite difficult to enter as a small US company. Japanese customers prefer to work with established Japanese organizations. FAX International will be able to meet the needs of the market by entering into a joint venture agreement with a large Japanese firm that already has access to the target customers in Japan.

The company has also met the demands of the customers by providing them with a network that is not only seven times faster than the AT&T switch-voice network but is also able to provide up-to-the-minute information on the status of the customers' documents as they move through the network. As a result, the level of the company's product-market match was high helping the venture's profile move towards one of high potential.

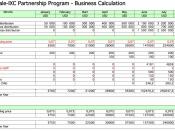

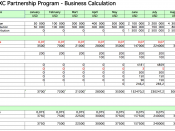

Are There Margins? Once the minimum efficient volume level of 7,000,000 minutes of traffic/year is achieved the company will earn a 50% gross margin on their sales revenue. As seen in FAX International's Year 1 Assumptions and Ratios table the company will achieve this 50% gross margin by May 1992. In addition, by July 1993 the company will achieve an EBITDA margin of 31%. As a result of FAX International's high margins, there will be room for the company to maneuver if a price war takes place.

Is There a Net-Buyer Benefit? The deregulation of all enhanced telecommunications services by the European Economic Community and the signing of the IVANS agreement between the US and Japan has created an opportunity for a variety of international telecommunications companies including Fax International. In addition, switch international facsimile traffic is growing worldwide at more than twice the pace of voice traffic (30-40%/year compared to 15-20%/year). The high growth rate and increasing demand for international facsimile services illustrates the potential net-buyer benefit that can be obtained Is it Repetitive? The product offering of FAX International is used very repetitively. In fact, companies send facsimiles several times a day. FAX International has even identified a means of increasing the repetitiveness of their product offering by proving free auto dialers to companies where their volume of traffic is at least 10 minutes per day. The high repetitiveness of FAX International's international facsimile service is a strength to the venture pushing it towards the profile of a high performer.

Is it Non-Imitable? The potential for opportunism in this industry is great. FAX International anticipates the emergence of a large number of small competitors as a result of the high growth rate of international facsimile traffic. FAX International will be able to penetrate the Japanese market and receive a first mover advantage, however, competing will soon arrive with similar facsimile services and could potentially decrease Fax International's market share.

Is it Non-Substitutable? With regards to international telecommunications there are several means of sending information worldwide including over the phone, through the mail and by means of the Internet that was emerging at that time. The potential for businesses to send information through the mail rather than by facsimile reduced demand. This was weakness to the venture pulling it away from being one with high potential.

Is There a High Level of Core Competency in the Venture? FAX International has a very strong management team with extensive knowledge and experience in the industry. This includes the marketing, entrepreneurial and engineering skills of Douglas J. Ranalli, the telecommunications background of Dr. Thomas P. Sosnowski as well Douglas Fine's experience with negotiating joint ventures for US firms interested in entering the Japanese market. With the knowledge and experience of the management team, FAX International will be able to perform several specialized tasks critical to the success of the business. This includes the joint venture with established Japanese firm, the installation of the network.

Evaluation of the Business Plan Overall, I was quite impressed with FAX International's business plan. I felt that the plan was effective and provided most of the necessary information that an investor would need. I also felt that the format was well structured which made it easy to read. In addition the plan was attractive and brief (under 30 pages). There were however, some areas of improvement.

Strengths and Weaknesses One of the major strengths of FAX International's business plan was the executive summary. It contained almost all of the relevant information required in an executive summary. It was keep brief and provided the reader with a synopsis of the entire business plan. It described the concept of the business and the opportunity that existed first then it explained the competitive advantages of the company along with the profit margins. By doing so the reader became immediately interested with the venture. Although, a weakness of the executive summary the lack of emphasis on the management team. I view the management team as a great asset to this venture and believe that there should've been more emphasis on it in the executive summary. As well, the description of the target market was somewhat broad. It stated that the company was going to target businesses in Tokyo, Paris and London but not which businesses.

I was very impressed with the market plan and market research of the business plan. FAX International has thoroughly examined the markets in which it is going to penetrate including the market's size and trends as well as the company's anticipated market share. I believe that their pricing strategy was well articulated and stood out to the reader. However, the distribution strategy (partnering with an established Japanese firm that already has access to target consumers in Japan) should've had more emphasis since it also explained how the company was going to conduct advertising and promotion.

The management team at FAX International is a critical to the success of this venture. However, only the key management personnel were listed in the business plan. There was no mention of the Board of Directors, shareholders or other stakeholders in this venture. As well there was no organizational chart to illustrate the hierarchy within the organization. Lastly, the explanation of the network was both comprehensive and user friendly, however, the Hardware Block Diagram on page 345 was somewhat confusing to understand.

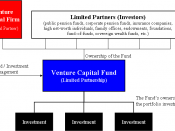

Fundraising and Financial Strategies As seen in the executive summary, FAX International requires an equity investment of $1,000,000 combined with equipment lease loans representing assets worth $1,500,000. In order to obtain the equity investment Douglas Ranalli could sell a portion of the company through and initial public offering or a reverse take over bid to get listed on a stock exchange and obtain equity financing. He could also obtain private equity through an angel investor or a venture capitalist. With regards to the debt financing needed for the equipment Douglas Ranalli may have to put up his personal assets as collateral to secure the loan, which may not be enough. I recommend focussing on government sources of funding to decrease the loan amount.