Microsoft Excel enables user to recalculate complete spreadsheet quickly to evaluate different outcomes. There are some modeling techniques that user can use as a comparison for making financial decisions from several variables (Presto, pg. 326). They are Sensitivity analysis, goal seeking and sensitivity analysis.

I. Sensitivity Analysis

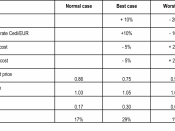

Sensitivity analysis is "a process of analysis the changing of a single variable in a small increments or decrements to see how sensitive model results are to the small changes in the said variable". It will enable user to determine the impact on a model' results of changes made to only one input variable or data factor while holding all other variables constant (Encyclopedia, 2004).

The small changes to this input variable may result in dramatic changes to the results. This is called the high sensitivity to this input variable. If a change in this input variable produces little overall change in the results, thus it has a low sensitivity.

As a result, sensitivity analysis allows the decision maker to determine which input variables have the most impact on the organization's bottom line. It allows the decision maker to determine the key variables in a decision. It can also be used to determine the margin of error in decisions involving those variables (Ian, et al., pg. 91).

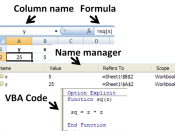

There are some ways that the sensitivity analysis can be performed. They are spreadsheet package, financial modeling language, decision support package, and add-in to spreadsheet package.

The least efficient and most common approach is to use a spreadsheet package to repeat the scenario (what-if analysis) process over and over again. This process is repeated for a range of values for that input variable, and the results recorded. This would enable the user to identify those input variable that cause the largest change in the output...

Financial modelling

Yours is a good essay on how financial modelling techniques can be used by a CPA but you need to include a bibliography to augment your internal citations.

5 out of 5 people found this comment useful.