This case discusses the valuation of stocks and bonds. It says that in textbooks, the valuation of stocks and bonds is simply stated as the present value of all the future cash flows expected from the security. The concept is logical, straightforward, and simple. The valuation of bonds is usually presented first, since the relatively certain cash flows are broken into an annuity and a payment of the par value at some specific date in the future. Preferred stock valuation follows bond valuation and the value of preferred stock is shown to be the present value of perpetual annuity. The cash flows from the constant-size dividend are fairly certain, and most preferred stocks do not have a maturity date. Finally, common stock is presented but neither the future cash flows (from dividends) nor the final value is known with any degree of certainty.

The case describes Home Products, Inc, a leading manufacturer of prescription and ethical drugs; specialty foods and candies; and proprietary drugs.

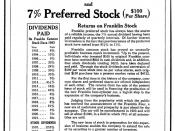

Total revenues in the last fiscal year were in excess of $9 billion. Company's capital structure is made up of 34% long-term debt, 3% preferred stock, and 63% common stock. The case describes the two largest domestic long-term debt, and close this issue disclosing that these two bonds are rated A by Moody's. Then, it talks about preferred stocks. 5.5 million shares were issued in Feb. 1979 in connection with the merger of FDS Holding Company onto a subsidiary of HPI. Finally, it describes the common stock and informed that returns from common stocks come from the cash dividend payment and /or changes in the price of the stock. Two major factors that affect the price of stock are changes in the required rate of return, caused primarily by changes in risk, and change in the...