Question 1:

1) Woolworths limited are involved in activities of Retailing through chain-store operations that are in various cities of Australia. They deal with the sales of food, consumer goods and general merchandise.

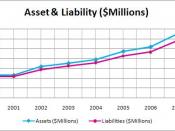

2) Accounting Equation of Woolworths limited for 2005:

Asset = Liabilities + Owners Equity

Start Date 28 June 2004: $6,145.4 million = $4,092.9 million + $2,052.5 million

End Date 26 June 2005: $8,957.9 million = $6,760.8 million + $2,197.1 million

3) The basis of measurement for the Woolworths has been prepared on the basis of Historical Cost of company.

4) Consolidated net profit for financial year 2005 for Woolworths:

Net Profit = $791.6 million

5) Consolidated cash flow from operating activities for year 2005:

Cash flow for operating activities in 2005 was $1,221.0 million.

Cash flow did not increased compared to last financial year.

6) "In general, revenue is recognised only when it is probable that the economic benefits comprising the revenue will flow to the entity and that the flow can be reliably measured" (Annual report Woolworth's limited page 1).

Entity needs an accounting policy for revenue recognition because it means to include an element in accounting record and on the face of a financial statement (Financial management). This category is assigned to the revenue recognition because revenue are generated or arise from the ordinary activities of entity so they are needed to be recognised as different element not as Gains.

7) Role of directors' report:

Directors' report provides mainly with information related to companies' directors' who they are and what are there qualifications and there name. It also says the following

1) Principal activity of the company during the financial year they also state of any changes which are going to take place in future activity.

2) Consolidated results and review of operations of the...