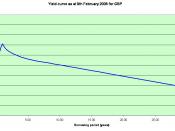

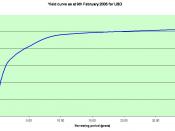

The yield curve is a graphical representation of the present average of all short, intermediate, and long term interest rates. Years to maturity for US Treasuries are plotted along the horizontal, or x-axis, while interest rates are plotted along the vertical, or y-axis. The structure of the yield curve is determined by the expectations and actions of borrowers, lenders and arbitragers in response to expectations of interest rate movement. The yield curve can be useful for signaling prospects ahead for the economy and interest rates; however, the yield curve is based on individuals' opinions and it should be noted that the yield curve may be misleading, and should always be used in conjunction with other tools.

The Treasury yield curve shifted to a steeply upsweeping slope because borrowers, lenders and arbitragers expect interest rates to rise, with long term rates rising far greater than intermediate rates, and with intermediate rates rising far greater than short term rates.

The relative pressure of demand for borrowed money drastically navigated towards the long end of the market, while lenders are channeling a greater supply of funds, relatively speaking, to the short end of the market. These demand and supply pressures, along with expectations of rising interest rates explain the upsweeping yield curve.

A steeply upsweeping yield curve invokes expectations of rising interest rates, and borrowers, lenders and arbitragers would be wise to react appropriately. Borrowers should borrow long, locking in a low rate. Lenders should lend short, because if rates are correctly determined to rise, lenders will miss out on more profitable lending opportunities at higher rates. Arbitragers should borrow long and invest short. With a correctly-assumed upsweeping yield curve, prices on long bonds will drop and arbitragers do not wish to be stuck with them.

Failure to abide by these logical actions...