Executive Summary_____________________________ ________

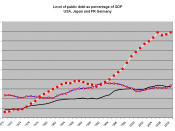

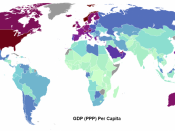

The Argentine financial crisis took place between 1999 and 2002. However, events dating back to 1990 help in understanding why the crisis happened, and would help prevent it from happening again. In 1990 Argentina was in a recession. To solve this problem the Argentine government implemented the Convertibility Plan. Within a year the country was experiencing exceptional improvement, and the economy continued to grow until 2004. In 2005 the Tequila crisis in Mexico triggered a recession in Argentina; however, the country rebounded fast thanks to help from the IMF. Another, smaller growth period followed, and lasted until 1998 when the Asian and Russian financial crises hit. This economic downturn in the macro environment had a great effect on international financers who, as a result, became less risk averse. At this point Argentina's debt had become too much for their economy to handle, and the financial crisis began.

After Argentina fell, close trading partners, such as those in MERCOSUR, began to feel the effects on their economies. Because Argentina had defaulted on loan payments to the IMF, the fund refused to bail them out; however, they did loan money to neighboring countries to try to prevent a spread. Eventually the IMF and Argentina were able to resolve their differences, and prepare a repayment plan. Soon after, the countries economy began to improve. This in turn had a positive effect on neighboring countries. The process for them was much easier because they had learned from Argentina's mistakes. Now, Argentina is on its way to recovery, but it still has a long way to come.

Introduction____________________________________________

The Argentine financial crisis ravaged the country throughout 2001. This period was marred with rampant inflation rates and job loss, scenes of malnutrition among youth, and families scouring for anything that could be...