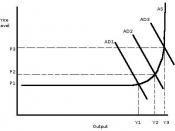

In today's economy, there are devices present called automatic stabilizers. Automatic stabilizers, are mechanisms which aid in the correction of an economic problem without the interference of anyone or anything. They are perhaps most useful to combat demand - pull inflation. Demand - pull inflation, is when prices rise because the economy cannot produce enough goods to satiate the economy. An automatic stabilizer, that is beneficial to combat such a problem, is a progressive tax. A progressive tax, is a tax that becomes a higher rate for each increasing level of gross domestic product. If such a tax is present within the economy, when the society becomes more prosperous, such as in the situation with demand-pull inflation, the citizens are taxed more, therefore decreasing the marginal propensity to consume, and decreasing consumption. The marginal propensity to consume is the fraction of any change in disposable income spent for consumer goods.

If this decreases, demand will not be as high above, or even above where the supply is, therefore reducing the demand - pull inflation.

AS

P2 C1

P1 A.D.2 C2

AD1

45 deg.

The first graph shows the increase of price, due to the increase of demand in the vertical range of the aggregate supply curve, or demand pull inflation. The second graph shows the decrease of consumption due to the increase in the tax rate at the new higher income.

Tax T2

Rate T1

G

Income level

The graph above shows 2 different progressive taxes. T2 is more progressive than T1 because the tax rate increases more rapidly as the income level increases. The more progressive tax, stabilizes the economy better.

Another way to stabilize demand - pull inflation is to reduce government spendings. Government spendings, are the spending that the government make with the tax...