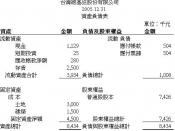

According to information found on the summarized Balance Sheet which is essentially an Income Statement the net income for Landry is $45,901,054. We found this income statement to be most helpful as it contains a summary of all the assets, liabilities and income for the year. The financial statement contains the revenue meaning, cost of revenue, gross profit, operating and other expenses, Interest Expense, Income tax expense, net income and earnings per share.

From an analytical standpoint the fact that three years of information is given on one sheet lets a potential buyer or banker have an overview of the companies' strengths and weaknesses all at once. Further observation tells me that the company has double its income in three years which would be an investors dream. We can also see if they are over their heads in debt by viewing the operating expenses. If Landry's were spending more than they are making then that would be a cause for concern before investing in the company.

There may be some things that could be cut to decrease operating expenses. Certainly, there could be some federal programs which would allow for some deductions in the amount of income tax expenses should be paid.

This comprehensive balance sheet contains all of the elements needed to do an evaluation of the company's worth. You can see exactly what Landry's spent to make money as well as, the net income. We believe the balance sheet gives you the most information overall without having to wait for revisions or other calculations.

Landry's total assets can be found on the balance sheet. The balance sheet provides a quick snapshot of a company's assets and claims against those assets at any given time. On December 31, 2003, Landry's total assets were valued at 1,102,785,506. The balance sheet...