Financial Theories � PAGE \* Arabic �10�

Financial Theories

David, Rishi, Vinod, Praneet

University of Phoenix

Finance

554

Cale Thomas

Oct 23, 2006

�

Financial Theories

Capital structure theory is a challenging issue in corporate finance. Even after four decades of numerous studies and theories on the subject of capital structure, researchers are still puzzled by their inability to provide a simple and concise answer.

The Modigliani and Miller Theorem:

Franco Modigliani and Merton Miller were two individuals who sparked interest in capital structure theory. Their original insights (1978) and continued developments (1963, 1965) laid the foundation for modern corporate finance. However, both lacked the practical applications of the theory on individual firms and the impact on observed facts such as corporate leverage ratios and market reactions to security issues.

The Modigliani-Miller theorem is stated in a perfect market. The only market imperfections they admit are corporate taxes (Modigliani and Miller, 1963).

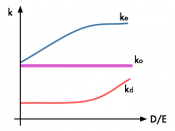

M and M states that the cost of equity depends on three things: the required rate of return on a firm's assets, the cost of debt and the debt / equity ratio. [Good]

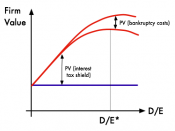

As a firm raises the debt / equity ratio, the increase in leverage raises the risk of the equity and therefore the cost (RE) (Ross, 2001). [Excellent] The risk of the equity depends on two things: business risk (i.e. The riskiness of the firm's operations) and financial risk (i.e. The degree of financial leverage). The theory implies that a firm's debt-equity ratios could be anything. They are the result of random managerial decisions about how much to borrow and how much equity to issue. The Modigliani-Miller theorem is certainly one of the most important theories, although not the most realistic. [Good]

A question quite often asked is do real-world managers follow M and M by...