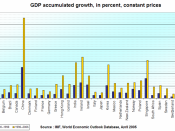

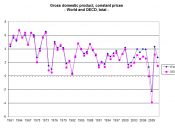

The Econometric analysis will test the variable "GDP % Growth" as the dependant variable, and how it is affected or explained by the independent variables: "Agricultural % Growth", "Industry % Growth", "Manufacturing % Growth" & "Services % Growth". The data is cross-sectional spread over 77 countries and all the growth rates are for the period 1990-2001.

Y = a + B1X1 + B2X2 + B3X3 + B4X4

Y = GDP % Growth

a = constant

X1 = Services % Growth

X2 = Agricultural % Growth

X3 = Industry % Growth

X4 = Manufacturing % Growth

I predict the coefficients to be positive, however the highest impact on GDP % Growth from services and industry growth. This is, as the growth of GDP will encompass the combined effects of the growth of the economy's various sectors, however in most developed countries the services will play the largest part in determining GDP growth, whilst similarly manufacturing and industry will be in the developing countries.

These variables will have higher coefficients and t-values if the prediction is correct.

The variables "manufacturing growth" and "industry growth" were defined differently in a technical classification sense, however are likely to be very similar and have a degree of collinearity so, it may be that one of these variables will have to be dropped, depending upon how large the covariance is.

It will be important to recognise the conditions for accurate ordinary least squares regression, so to obtain accurate estimates with in the regressions. This aims to minimise the sum of squares of the residuals, giving the best fit of the estimated model. These conditions are given as the Gauss-Markov conditions, which state;

* Expected value of the disturbance term in any observation should be E(ui) = 0, and therefore should not have a trend in...