Balance sheet is an integral part of the financial reports of a company. It is the snap shot of the state of affairs of the company at the end of its fiscal period. However, it does not necessarily reflect the true value of the company. Financial reports give a true and fair view of the company (FSA Handbook 2004) as the audit standard for financial reporting. Discrepancies arise because of the cost of accounting accuracy, the different valuation method, and financial reporting principles. In the following paragraphs, I will further analyze the discrepancy and its causes.

It is not impossible to account for each and every penny for a company. However, the marginal cost of accuracy rises exponentially. Financial accounting principles recognise that human errors are inevitable and the cost for 100% accuracy does not justify the saving from the elimination of insignificant reporting errors. Therefore, audited financial reports are reasonably, not absolutely, accurate.

Provisions for bad debts, for example, is a subjective estimate made by the management of the company relying on experience and past records. If we are looking for the true value of the company, true being the implication for a 100% accuracy, then Balance is certainly not up to the task.

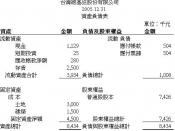

Although the above accuracy causes can be viewed as nitpicking and semantic, the second cause of the difference is quite obvious. The difference is in valuation. Balance sheet items are recorded at cost. For example, a share of a public traded company is listed at par value plus any premium paid in the share holder's equity. The same share of stock can be traded for many times of its listed value in the exchange. For another example, a real property purchased years ago can be listed at its original purchase price despite its market value...