BUAD 659

Strategic Management

Table of contents

3Introduction & Description �

4Industry/Market Analysis �

9Company Strengths and Weakness �

11Company Strategy �

14Strategy Implementation �

16Recommendation and Conclusion �

18Appendices �

18 Tables and Graphs �

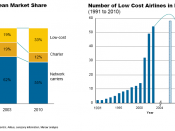

18Graph 1: Low cost market share 33% by 2010 �

19Graph 2: Porters Five Forces �

20Graph 3: Strategic groups map for Ryanair �

21Graph 4: Ryanair Passenger Growth of 18% for June 2007 �

22Graph 5: Ryanair No 1 Again for Customer Service �

23Graph 6: Ryanair Beats BA - Again! Ryanair Grows 18% as BA Shrinks by 2.5% �

24Graph 7: IATA Confirms Ryanair is World's Favorite Airline �

25Graph 8: Ryanair Financial results for FY07. �

26Graph 9: Route Map of Ryanair 2007 �

26Bibliography �

�

Introduction & Description

Ryanair was founded in 1985 by Christy Ryan, Liam Lonergan (owner of an Irish tour operator named Club Travel), and noted Irish businessman Tony Ryan, founder of Guinness Peat Aviation.

Christy Ryan was from Waterford and it was his idea to start an air service between Waterford and London. To start with airline began with a 15 seat Embraer turboprop aircraft flying between Waterford and London Gatwick with the aim of breaking the duopoly on London-Ireland flights at that time held by British Airways and Aer Lingus.

Ryanair has been characterized by rapid expansion, a result of the deregulation of the air industry in Europe in 1997. Over the years, it has evolved into one of the world's most profitable airlines, running at remarkable margins by passing its costs directly to its customers. Ryanair is the largest airline in Europe in terms of passenger numbers.

Ryanair's objective is to establish itself as Europe's leading low-fares scheduled passenger airline through continued improvements and expanding offerings of its low-fares service. Ryanair aims to offer low fares that generate increased passenger traffic. A continuous focus on crucial success factors like innovation, extremely simple, strong pricing strategy and operating efficiencies are a vital factors of the Ryanair success. Ryanair's no frills strategy does not only mean a cut in cabin crew, but also allows for a faster pre-flight preparation, thereby reducing the time grounded as well maintaining low fare. Ryanair offers slightly different prices between the weekend and weekdays, this leads to unit revenue largely higher than the basic price.

Ryanair is an Irish airline headquartered in Dublin, Ireland. It is established itself as Europe's largest low-cost carrier and dynamic as well as the number one in customer service. Also it is one of the world's largest and most successful low cost airlines. This is evidence in the fact that it has consistently achieved a compound annual growth of 20% since 1991 with a current market capitalization of 5bn, ahead of British Airways (4.3bn), Lufthansa (4.7bn) and Air France/KLM (3.5bn), and with high statistics in customer satisfaction (Appendices-Graph 5).

Ryanair operates on 460+ routes to 25 countries with project annual passenger growth rate as 25% (Current passenger growth is 18% - Appendices - Graph 4). In the current year potentially Ryanair plans to carry 52m passengers on 499 low fare routes across 26 European countries, with 20 European bases and by the end of March 2008 Ryanair plans to operate a fleet of 163 new Boeing 737-800 aircraft with firm orders for a further 99 new aircraft, which will be delivered over the next 5 years. Ryanair currently employs a team of 4,500 people, comprising over 25 different nationalities.

Ryanair has been successful and able to maintain their competitive position in the low-cost airline market space, due to following key successful factors:

No Frills, Low Cost Approach

Low Ticket Prices

Point-to-point Short Haul Flights

Operational in Regional and Secondary Airports

Production costs lower than competitors.

Powerful communication and strong marketing strategy.

Ability to influence the policy and behavior of the competitors.

Industry/Market Analysis

The European airline industry was one of the most heavily regulated and protected sectors. For the most part, carriers were state-owned and enjoyed a legal monopoly over domestic traffic. Governments used to control entry to foreign companies by means of restrictive bilateral Air Service Agreements (ASA). And only the carriers registered in each signatory state were allowed to operate commercial services. But in general, the countries allowed only its state-owned flag carrier.

In 1980, the European Community took some new measures in order to liberalize the intra-European air service. This deregulation, aimed to substantially reduce the EU member states' ability to restrict their market entry to foreign companies. Since April 1997, European airline companies have been allowed to provide passenger services on domestic routes within EU member states, even if it is not its registration country. Ryan air grabbed the opportunity to establish itself in airline market space, with diligent planning and no-frills strategy, and has shown steady growth. In year 2005 the company has transported 35 million passengers. Moreover, the company has the best operating margin around 25%.

In airline market space low cost airlines are growing at an annual rate of 20%, and currently control 7% of EU market share, in terms of passengers' number, with an increase of around 14% forecast for 2007. The low cost airline market penetration still differs significantly among EU member-states compared to Ireland and the UK.

In the airline industry, flights are considered as products which seem to be quite differentiated between mature and budget airlines, but within the budget sector of the "no frills" airlines, the products are more homogeneous concerning the services the passenger buys, and only differ in prices. The low cost airline business has experienced extraordinary growth in recent years in terms of passengers carried, airlines launched, aircraft ordered and distribution worldwide. Taken together, all these new-model operations are set to represent an even greater proportion of the total commercial airline industry in the future.

Generally speaking, Low-cost airlines have turned away many problems that could be coupled with consumer confidence, and have remained cost-effective. The success of the low-fare strategy is critically dependent on the maintenance of a low cost base. Lower costs are the only competitive advantage in the short-haul economy sector since air travel is effectively a commodity product. The market entry and continual increase in low-cost carriers and their business models create a lot of new potential for the economy. Competition grows among the airlines and the Internet improves the transparency of airfares. While it's true that lower prices are used to lure passengers to the low-cost segment, high prices are often charged for changes to reservations and excess baggage. Price, growth and increased passenger numbers due to tighter seating open up myriad opportunities for budget passengers. Based on, Mercer Management Consulting forecasts a low-cost airline market share would be 33% in Europe by 2010 (Appendices, Graph 1). But the boom also harbors the risk that with all probability some of the low-cost airlines won't survive and shut-out of competition due their continued dependence on the price of oil.

Industry key success factors

Low Ticket Prices

Frequent Departures

Possibility of Advanced Reservations

Reliable Baggage Handling

Powerful communication and strong marketing strategy

Consistent On-time Services

Also it is worth to note that Low cost airlines operations through regional airports works as catalyst for driving of enormous growth for regional airports and development of regional airports. Hence low cost airlines represent significant growth opportunity for regional airports.

Stimulate growing demand for air travel

Draw existing traffic from other airlines/airports/other transportation modes

Create healthy competition between regional airports

Porter's Five Forces Analysis (Appendices-Graph 2), the Porter Five Forces analysis on Ryanair offers a good explanation for the profitability of low cost airline industry, and the firms within it, also it enables us to evaluate Ryanair competitive advantage to make a decent profit. Hence the collective strength of the five forces determines the ultimate profit potential of a low cost airline industry.

Threats of New Entrants: Medium: This force analyses the threat of new entrants who can potentially grab the market share of already established companies. In the case of Ryanair a strong brand identity built up over the period since deregulation has meant that any potential new entrants would have to outlay high investment in terms of sunk costs in advertising to compete on a level playing field. Following are some factors which could effect the new entrants:

High Capital Investment

Restricted slot availability to find suitable airports

Compete on limited routes

Need for low cost base

Flight authorizations

Rivalry among existing firms: High: This force analyses competitive rivalry in low cost airline market space, the cost of increased competition is quite high; however Ryan air has benefit of two vital key success factors, 1) First Movers 2) Maintaining its low cost image steady. Essentially following are some factor which could influence industry competition:

Increased competition in low cost airline market space

Most cost advantages can be copied immediately

Selection of operating routes

Maintaining low prices is key

Partnership between competitors ( example; 2 partnered low cost airline compete against 3rd low cost airline)

Threats of substitute products: Medium: The threat of substitutes to the airline industry comes in three main forms; road, rail and to a lesser extent the boat service. Rail seems to offer the greatest threat because, rail network around Europe, offers an excellent continental service around the major cities that Ryanair operates. Rail travel has several advantages over air in terms of the fact that they can be more localized and more accessible but one must endure a longer journey also. Ryanair can offer a faster journey at prices that can often be far cheaper. Similarly car travel offers similar advantages to that of the railways but Ryanair will always be able to boast shorter journey with less hassles.

Multiple modes of transport, e.g. Rail, Car, Boat etc.

Low - Medium switching cost to customer

Technological advancement - Real need for physical presence in business meeting could be substituted by video conferencing

Buyer's Bargaining Power: Low: Customers are price sensitive and due strong internet technological presence across the customer community, switching from one airline to another is negligible. Hence it is difficulty maintain loyal customers base for a specific airline, unless there is airline affiliation/promotion programme like frequent flyer programme, where customer would re-think before buying ticket from competitor to gain the miles. Hence flowing are the main factors which would influence this porter's force.

Switching cost to another airline is relatively negligible ( Booking for all airlines are available online)

Customers know about the cost of supplying the service

No loyalty

Supplier's Bargaining Power: Low: At a high level survival of airline industry depends on two major vital ingredients i.e. airline and fuel, hence industry is limited to 2 suppliers. Ryanair has strong alliance with airline supplier Boeing. Boeing supplies aircraft 737-800, and provide various ancillary goods & services to Ryanair. These include technical support and training, spare parts support, training of the flight crews, software and field services engineering. Aviation fuel prices is something no one in airline industry has much control as, the price of fuel is governed by world trade and Middle Eastern countries. However these could be bargained by working with govt. Following factors influence the supplier's bargaining power.

Not much choice for aircraft selection - Boeing or Airbus

Supplier switching cost is very high - Training for tech. team & Pilots.

Price of aviation fuel is directly related to the cost of oil

Regional airports have little bargaining power as they are heavily dependent on specific airline, establishing base for same

Strategic Group Map (Appendices - Graph 3), Strategic groups map for Ryanair clearly identifies major and indirect rival from airline industry who are pursuing equivalent strategies. Strategic groups map for Ryanair clearly identifies major and indirect rival from airline industry who are pursuing equivalent strategies. One group consists of airlines with regional operations that offer scheduled flights and compete on purely cost. The second group offer charter services to a range of holiday destinations. The third group is constituted of major airlines with successful global operations and offer scheduled flights with quality environments and service.

Currently there are wide ranges of low cost airlines to capitalize the potential of low cost airline market space; easyJet, Virgin Express, and Aer Lingus are few major competitors to Ryanair; however Ryanair is maintaining its competitive edge by diligent strategically planning, strong marketing and utilizing the potential internet technology for direct booking on the Ryanair website with savings of 42.6% in marketing and distribution costs.

Financial Analysis: Based on the current results, Ryanair has posted record profit of Euro 401 Million, i.e. Profits up by 33% due to traffic growth 42.5 million (Appendices - Graph 8). Following are financial ratios for financial statements for year end March 31, 2007.

ROE = Net Income / Owner's Equity = 433279/ 2539773 = 0.17059 = 17.059%

ROA = Net Income / Total Assets= 433279 / 5691245 = 0.0762

LEVG = Total Assets / Owner's Equity = 5691245 / 2539773 = 2.24

ROA = ROS * ATO = 0.19369 * 0.39304 = 0.07613

ROS = Net Income / Total Revenue = 433279/2236895= 0.19369

ATO = Total Revenue / Total Assets = 2236895/5691245 = 0.39304

Current Ratio = Total Current Assets/Total Current Liability = 2354276/1117730 = 2.1

Based on analysis of financial ratio, it is clearly evident that Ryanair is financially in strong position. Ryanair has ability to grow without large capital expenditures (ROE = 17.059%). Ryanair has ability to generate 7.6% of per dollar (or Euro) investment. Total current assets are greater that Total current liability that shows that Ryanair is performing well and is strong for short-term financial strength, also it able to efficiently manage its current assets according to higher ATO

Company Strengths and Weakness

SWOT Analysis for Ryanair will enable us to understand their chosen strategies from an external as well as an internal perspective. Overall Ryanair has an outstanding ability to strategize its moves and maintain its focus to keep lowest production costs.

SWOT Analysis

Strength: Low cost strategy is an obvious key strength of Ryanair. The company is able to successfully apply this strategy in recognition of simple company logistics, effective use of airtime and high traffic. In addition, the focus on secondary airports allows minimizing landing and ground handling fees. It also benefits from the 'first mover advantage' since it was the first low budget airline on the European market. This enables the airline to develop a powerful brand while stimulating demand with low prices. With its low cost approach Ryanair has proven to be an excellent niche strategy.

Low Cost Leader

Innovative Cost Reductions

First-mover Advantage

Established Brand Name & Market Share

Substantial Growth

Fast Turnaround

Innovative technological utilization - Internet bookings

High seat density and aircraft utilization

Established well connected point -to-point Routes/Network

Operations from regional airports

Range of Ancillary Services

Weakness: Reliance on secondary /regional airports could turn into negative specifically w.r.t attracting new customers and it depends upon distance factor of regional airport, at the same time it advantageous to add new regional airports to enlarge its growing route network. The airline may also face problems on domestic markets where competition is already very high and other full service airlines provide only slightly higher prices than the ones Ryanair would be able to offer.

Prone to bad press

Distance of some regional airports from advertised destination

Extremely sensitive to changes in prices

Volatile Customer Relations

Antagonistic Relationship with Competitors

Uncharacteristic Management Expansion

Dependence on Michael O'Leary

Opportunities: Ryanair opportunity to develop regional airports (especially near big airports, such as 'Hahn' closed to Frankfurt, Germany and 'Charleroi' in Brussels,

Belgium) as an operational base is one of the key cost saving factors, which will allow them to serve more routes and to interconnect flights between the bases. Ryanair can also seek opportunities on the mature airline market and target business travellers on these routes, which are not served by bigger airlines at all.

Further Growth

Advanced Cost Reduction

Offering Free Flights

EU Expansion

Expansion of ELFAA ( European Low Fares Airline Association)

Economic Slowdown - Customers from traditional carriers will seek lower fares

Geographical expansion of operating routes into non European countries

Threats: Generally speaking airline industry faces two major threats over which no one has any control viz; air accidents, and aviation fuel prices. Retaining customer base and having customers not switch to alternative ways of transportation.

Limited growth on the South European market

Regional airports gain bargaining power for "second round".

Customers are very price sensitive

Face increase in air traffic control charges

Increase in aviation fuel price and dependence on oil markets

Increased Competition:

New Entrants

Alliances/Mergers Between Competitors

Industry Criticism

Antagonistic Attitude of EU Commissioners

Non Expansion Into New EU States

Trade Unionism

Substitute Transportation:

Cars

Trains

Company Strategy

Ryanair's objective has been to establish itself as Europe's leading low cost airlines through continued improvements and expanding offerings of its low-fares service. Ryanair aims to offer low fares that generate increased passenger traffic. A continuous focus on cost containment and operating efficiencies is a vital part of its success in low cost airline market space. Following are the key elements of Ryanair's strategy:

Low fares: Customers are prices sensitive, and low fares is the best way to stimulate demand, they target fare conscious leisure or business travelers who might otherwise not traveled at all or use other methods of transport such as car, coach or trains. Ryanair begins with two initial cost advantages stemming from their very basic principle of 'no-frills'; these are having a higher seat density and higher daily aircraft utilization than other airlines. They do not operate a business class and narrow the galleys in between the rows of seats to reduce the seat pitch. Ryanair fit 15% more seats into their aircrafts than regular airlines. This enables them to have a higher number of passengers per flight than regular airlines.

Frequent Point-to-Point Flights on Short-Haul Routes: Ryanair provides frequent point-to-point service on short-haul routes to secondary and regional airports in and around major population centers and travel destinations. The average flight time has been 1.1 hours with an average route length of 746 kilometers in 2003. Ryanair's flew an average of approximately 1.94 round trips daily per route. The choice of only flying short-haul routes allows Ryanair to offer frequent service, while eliminating the necessity to provide "frill" services otherwise expected by customers on longer flights. Point-to-point flying (as opposed to hub-and-spoke service used by the traditional carriers) allows Ryanair to avoid the costs of providing through service for connecting passengers, including baggage transfer and transit passenger assistance costs. This is one of the key differences between Ryanair and traditional carriers.

Choice of routes: Ryanair favors operating through regional airports with convenient access to major population centers (e.g. London Stansted Airport) and regional airports (e.g. Brussels-South Charleroi airport). Regional airports offers competitive advantages, like access to customer base and handling costs but also provide a higher rate of on-time departures, fewer terminal delays and faster turnaround times (it is much quicker to land, unload and reload passengers and luggage and take off again at smaller less congested airports then at a major airports. The fast turnaround is a key element in Ryanair's efforts to maximize aircraft utilization. Ryanair's average turnaround time for the fiscal year ended March 31, 2007 was approximately 25 minutes. This has allowed the possibility to fit in two extra flights a day that would not be possible with a 60 minute turnaround time7. This allows Ryanair to not only save on costs but also adds tremendously to revenues. The 25 minute vs. 60 minute turnaround time in effect adds â¬4.4million in incremental revenue per aircraft per year.

Low Operating Costs: One of key to maintain low fares is by maintaining low operating cost. There are four main expenses which Ryanair is able to control and/or reduce:

Aircraft Equipment Costs: Ryanair's initial strategy for controlling aircraft acquisition costs was to purchase used aircraft of a single type, however this no longer became viable. In March 1998, Ryanair announced that it would start purchasing new Boeing 737-800 "next generation" aircraft. The 737-800s represent the latest generation of Boeing's 737 aircraft and share certain basic attributes in common with Ryanair's current fleet. Based on operational standpoint, strategy of limiting its fleet primarily to single type of aircraft from a single manufacturer enables it to limit the costs associated with personnel training, maintenance and the purchase and storage of spare parts, as well as affording greater flexibility in the scheduling of crews and equipment. Establishing Boeing as preferred vendor to Ryanair provides favorable benefits.

Personnel Expenses: Ryanair endeavors to control its labor costs by continually improving the productivity of its already highly-productive work force. Remuneration for employees emphasizes productivity-based pay incentives, including commissions for onboard sales of products for flight attendants and payments based on the number of hours or sectors flown by pilots and cabin crew personnel within limits set by industry standards or regulations fixing maximum working hours, as well as participation in Ryanair's valuable stock option programs.

Customer Service Costs: Ryanair has entered into agreements on competitive terms with third party contractors at certain airports for passenger and aircraft handling, ticketing and other services that management believes can be more cost efficiently provided by third parties. Management attempts to obtain competitive rates for such services by negotiating multi-year contracts at prices that are fixed or subject only to periodic increases linked to inflation. The development of its own reservations centre and internet booking facility has allowed Ryanair to eliminate travel agent commissions. For the fiscal year ended March 31, 2003, Ryanair generated virtually all of its scheduled passenger revenues through direct sales, with direct telephone reservations and sales through Ryanair's website generating approximately 6% and approximately 94% of the total, respectively.

Airport Access Fees: Ryanair attempts to control airport access and service charges by focusing on airports that offer competitive cost terms. Management believes that Ryanair's record of delivering a consistently high volume of passenger traffic growth at many of these airports has allowed it to negotiate favorable contracts with such airports for access to their facilities. Ryanair further endeavors to reduce its airport charges by opting, when practicable, for less expensive gate locations as well as outdoor boarding stairs rather than more expensive jetways.

Maximizing potential of Internet: In January 2000, Ryanair moved from conventional reservation system BABS (British Airways Booking System) to Skylights System. The Skylights system allows internet users to access Ryanair's host reservation system and to make and pay for confirmed reservations in real time through Ryanair's Ryanair.com website. Since the launch of the Skylights system, Ryanair has heavily promoted its website through newspaper, radio and television advertising. As a result, internet bookings have grown rapidly, accounting for in excess of 94% of all reservations on a daily basis as of September 2003. It is also a great asset in terms of producing ancillary revenues.

Commitment to Safety & Quality Maintenance. Ryanair's commitment to safety is a primary priority of the Company and its management. This commitment begins with the hiring and training of Ryanair's pilots, cabin crews and maintenance personnel and includes a policy of maintaining its aircraft in accordance with the highest European airline industry standards. Ryanair has not had a single incident involving major injury to passengers or flight crew in its 23 rd year operating history. Although Ryanair seeks to operate its fleet in a cost-effective manner, management does not seek to extend Ryanair's low cost operating strategy to the areas of safety, maintenance, training or quality assurance. Routine aircraft maintenance and repairs is carried out to make sure the safety is key priority.

Ancillary Services: Ryanair offers a variety of ancillary, revenue-generating services including on-board merchandise, beverage and food sales, accommodation reservation services, advertising, travel insurance, car rentals and rail and bus tickets. Ryanair distributes car rentals, accommodation services and travel insurance through both its website and its traditional telephone reservation offices. Management believes that providing these services through the internet allows Ryanair to increase sales, while at the same time reducing costs on a per unit basis. Ancillary revenues, excluding charters, increased by 68.1% (2002: 44%) and now accounts for 23.7% of total revenues compared to 9.4% in 2002.

Focused Criteria for Growth: Building on its success in the Ireland-U.K. market and its expansion of service to continental Europe, Ryanair intends to follow a manageable growth plan targeting specific markets. Ryanair introduced its first routes to continental Europe in the spring of 1997 and now serves a total of 62 continental destinations (incl. Scandinavia) from Dublin, London (Stansted), Glasgow (Prestwick), Shannon, Brussels (Charleroi), Frankfurt (Hahn), Stockholm (Skavsta), Milan (Bergamo), Rome (Ciampino) and Barcelona (Girona), etc

Strategy Implementation

Michael O'Leary, CEO of Ryanair, transferred the concept of a low cost airline from the United States (Southwest Airlines) to Europe. Ryanair's fares on average are about 50% lower than those of its competitors. The firm provides low levels of service in terms of food and other amenities on flights, but has fast turnaround on ground (20 mins). The firm's revenues increased by 32% and profits grew by 33% in 2007.

Michael O'Leary and his team has been a driving force behind strategic implementation of the strategies and turning them into core success. Ryanair management realized that consumers desire transportation that was fast and inexpensive. In order to provide such a cheap method of transportation, low costs and efficiency were essential. Thus, Ryanair transformed the industry business model by becoming a low cost carrier which was still able to maintain profits via reduced costs. Based on the Southwest low cost-low frills model, Ryanair created a strategy that drastically differed from the likes of British Airways, Lufthansa and Air France.

Ryanair's low cost strategic implementation includes changes right from the in-plane seating structure, high aircraft utilization, in-flight catering, the use of secondary airports, direct sales (mainly over the internet) and its fleet all being the same plane.

Ryanair begins with two initial cost advantages stemming from their very basic principle of 'no-frills'; these are having a higher seat density and higher daily aircraft utilization than other airlines. They do not operate a business class and narrow the galleys in between the rows of seats to reduce the seat pitch. Ryanair fit 15% more seats into their aircrafts than regular airlines. This enables them to have a higher number of passengers per flight than regular airlines. The effect of these extra passengers is exacerbated when one realizes that Ryanair actually has more planes in the air. This is done because they try to achieve a 20 minute turnaround at each destination which means that the planes are rarely left idle. These short turnarounds are also helped by the fact that there is not much cleaning to be done on the plane at the end of the flight because Ryanair do not offer free in flight catering. This is another major factor which allows Ryanair to work off substantially lower costs; indeed, Ryanair has even turned this aspect of the flight into a revenue making measure through selling snacks and drinks to its passengers. For the fiscal year ended 31st March 2007 ancillary services accounted for 23.6% of Ryanair's total operating profit.

One of the biggest cost saving measures employed by Ryanair is the fact that they make use of secondary airports as much as possible. This is vital because on short haul flights in Europe the airport charges can represent 10-13% of the airlines total operating cost and therefore, reducing these charges by half can cut overall costs by 6 or 7%. According to the CAA, Ryanair's airport charges per passenger are only one third those of British Midland. Ryanair are in a particularly strong position when it comes to negotiating new agreements with the various airport officials because many of the airports they operate from have a very minimal scheduled service. These low airport fees help to keep Ryanair's costs at about 65% below those of traditional airline meaning that they can offer cheap fares and still make a profit if more than 55% of its seats are occupied (McKinsey, 2001). Ryanair's use of point to point secondary airports has helped it maintain low costs as well. Secondary airports offer lower landing and gate fees than larger traditional airports. Also, these airports are less congested and thereby provide for a greater turnaround and aircraft utilization time. Despite the fact that consumers are often placed outside the cities of destination, passengers enjoy on-time flights; 88% of Ryanair's 180,000 flights were on-time in July 2007. Competitors like easyJet and British Airways stood at 74% and 71%, respectively (Appendices- Graph 5).

Ryanair also keeps their costs low because of their direct sales method. Within 3 months of them launching the Ryanair website (www.ryanair.com) in 2000, they were already taking 50,000 bookings a week on-line. By the end of 2001 75% of all bookings were done via the internet, whereas now it accounts for 90% of its daily bookings. These on-line bookings eliminate the travel agents booking fee which can be in the region of 7 or 8%. Ryanair do not have booking offices in the cities they fly to, thus cutting down on costly renting of prominent locations which may be required if the internet was not fully utilized. Also, since Ryanair offers a point-to-point service they do not issue for, or receive tickets from other airlines from transfers. This simplifies passenger revenue accounting and therefore allows it to be almost completely computerized. Ryanair's point-to-point service and use of secondary airports helps greatly with the fact that they keep their planes in the air for as much of the day as possible. In the fiscal year ended 31 march 2007, Ryanair flew an average of 7 flights per route per day with an average route length of 487 miles. This is much more than any regular airline.

Another low cost strategic implementation is making an aircraft fleet of same type (Boeing 737 series); this reduces pilots training costs, stocking spare parts and maintenance costs. Thus introduction of new aircraft should reduce maintenance costs. This is furthered in 2002 when Ryanair agreed to purchase 100 new Boeing 737-800 aircraft plus additional rights to purchase an extra 50; and although maintenance costs increased by 29% at the end of the quarter ended June '02, this is explained by the fleet that operated increasing and a subsequent increase in the number of hours flown. Michael O'Leary outlined that "despite strong growth Ryanair continues to deliver impressive cost discipline", this is justified by the fact that although in June '02 operating expenses had increased by 22% from the previous year, and revenues had increased by 29%

Recommendation and Conclusion

Strategically Ryanair has been huge success in low cost airline market space, and as the global economy proliferates, Ryanair has a strongest need to maintain its position and capture the additional market share by outperforming the closest competitors. Currently based on June statistics it has carried 45% of more passengers than competitor British Airways (Appendices- Graph 6), also Ryanair has earned name as worlds favorite airline according to IATA latest release (Appendices - Graph 7) .

In Europe 88% of the market is dominated by the two major players; Easyjet and Ryanair. However, within the European Airline Industry as a whole the low-cost carriers only represent 7% of total market share, Experts predict that the maximum potential market share in Europe is limited to about 14% in the next 5-10 years but that is only if Ryanair continue to limit service to Western Europe. Ryanair's success to date has been partly due to the fast pace at which the industry has been developing and since this market will not grow as fast in the future Ryanair must seek other ways to expand in order to sustain their top performance. Following are some key recommendation to achieve above goals:

Increase the Frequency of Existing Routes: The European low cost carrier (LCC) market is by no means exhausted. At the moment Ryanair have an average of 3.88 flights per day per route. This figure, compared to Easyjet and traditional carriers, is very low. This means that Ryanair are loosing out on business passengers who need more flexible timetables. If Ryanair were to increase the frequency on some of their routes they could effectively steal some of the passengers from the traditional carrier's thus increasing market share.

Open New Routes in Europe: There are many viable routes still un-served by low-cost carriers. In order for a route to be viable there must be at least 32,000 passengers per year. Research must be carried out to find viable routes before the competition. As well as opening routes to un-served destinations, Ryanair can also open routes where the competition is a more expensive traditional carrier thus attracting customers with the cheaper, no-frills option. In 2002, 33% of routes were served by only one low-cost carrier, an increase of 33% on the previous year's figures.

Develop Its Smaller Continental Operating Bases: With the low-cost market from London saturated, Ryanair must look to their other operating bases to expand their network. Dublin, Brussels, Hahn, etc⦠can all be developed. Although there is not the same demand outside of London there is still sufficient demand to make a sizable profit.

Expand into Central/Eastern Europe: Eastern Europe is fast becoming a hotspot for tourists and business travelers alike due to the continuing expansion of the E.U. Ryanair however don't serve any of these popular destinations. Other low-cost airlines have set up there already, such as Sky Europe, but not all routes have been exhausted. There is still plenty of opportunity in this area.

Expand into North Africa: Routes to North Africa are also very popular for both tourists and North Africans who have immigrated to Europe. SN Airlines currently dominates the traffic from Brussels to North Africa but they are neither a low-cost airline nor a traditional carrier. By offering truly low cost flights to these destinations Ryanair could easily capture this market share. Our aim is to seek out and start negotiations with potential airports in these countries.

Aggressively seek to take market share from the Charter Market: The Charter market represents a huge 25% of overall European traffic. Ryanair must aggressively attack this market by heavily promoting D.I.Y. holidays instead of package tours. With the increasing popularity of the Internet and the decreasing popularity of Travel Agents, this is a market that must not be overlooked. Ryanair has already begun to provide small packages for its destinations and we aim to bolster this side of the business.

Customer Service Overhaul: Ryanair has had a remarkable track record for its 'tangible' customer service (punctuality, flight completion etc) however the perception of the 'softer' side of its customer service has not always been good with much bad press. With this in mind Ryanair, while maintaining its strict rules and regulations, must make an adjustment in this area.

Continue to find ways of reducing costs: Although Ryanair has the lowest cost base of any of its competitors; we believe that the Company can continue to lower its cost base as it grows albeit at a lower pace.

Ryanair 100% online: Ryanair will continue to use the internet as its primary point of sale. Over the next 5 years the aim is to have 100% of bookings via the internet so as to eliminate the costly call centers.

Appendices

Tables and Graphs

Graph 1: Low cost market share 33% by 2010

Based on research and forecast of Mercer Management Consulting Low cost airlines, market share is likely to continue growing, but the current number of carriers does not look sustainable.

Graph 2: Porters Five Forces

Porter's five forces, a powerful analysis tool, strategically enable organization to analyze the current situation of industry in a structured format and determine the attractiveness of industry.

Graph 3: Strategic groups map for Ryanair

Strategic groups map for Ryanair identifies, Driving forces and competitive pressures, Profit potential of different strategic groups varies due to strength and weakness in each group's market position and closer strategic groups are on map, the stronger the competitive rivalry among member firms.

Graph 4: Ryanair Passenger Growth of 18% for June 2007

Graph 5: Ryanair No 1 Again for Customer Service

Graph 6: Ryanair Beats BA - Again! Ryanair Grows 18% as BA Shrinks by 2.5%

Currently based on June statistics Ryanair has carried 45% of more passengers than competitor British Airways.

Graph 7: IATA Confirms Ryanair is World's Favorite Airline

Graph 8: Ryanair Financial results for FY07.

Graph 9: Route Map of Ryanair 2007

Bibliography

Sean Brophy, Dominic St. George (2003), "Ryanair: Contestability and Deregulation", Student Economic Review, Vol.17, 245-257.

Wikipedia, (2007), "Ryanair" [Online]; http://en.wikipedia.org/wiki/Ryanair, (September).

Tony Hill & Helen Gillilan (2006), "Ryanair 'best For Customer Service' "[Online]; http://www.holidayextras.co.uk/news/travel/18173661.html

Lotta Koivula and Elshad Mirzayev (2005), "When the Network Strategy Is Not Enough - The case of European Full-Service Airlines", (January).

Peter R. Costa, Doug S. Harned, and Jerrold T. Lundquist (2002)," Rethinking the aviation industry", The McKinsey Quarterly

Vincent Grimaldi (2003), "French Accent - Ryanair Slow on Emotion,[Online] http://www.brandchannel.com/brand_speak.asp?bs_id=72, (October)

Jay Sorensen (2006), "Europe's Top 4 Low Cost Carriers generated 470 Million Euros (US$593 Million) from Non-Ticket sources in 2005", IdeaWorksCompany.com (October).

BUAD 659 � � PAGE �1� of � NUMPAGES �26� BUAD 659 � � PAGE �2� of � NUMPAGES �26�