Anthony Alonso

4213-9739

FIN3403

Group 10

The Debt Ceiling

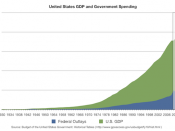

In "Debt Ceiling made easy," Ali Velshi summarizes the basics of the United States debt ceiling. Velshi compares the debt ceiling to be like the credit limit on a credit card. The U.S. borrows money to fund our economy. Government programs such as Medicaid, Social Security, Disability, and other similar programs are funded based of the U.S. debt ceiling. One can think of the debt ceiling as the credit limit for the government's "super loan." Once the national debt level has reached the debt ceiling, the United States can no longer continue to borrow money unless the debt ceiling is raised. In order for the debt ceiling to rise, Congress must vote in favor of the increase. This procedure is different from most countries, where countries will simply continue borrowing money without a legislative approval. Currently the debt level of the United States is at 14.3

trillion dollars. This level represents the debt ceiling approved by Congress, thus in order to remain solvent, the debt ceiling must be raised.

After gaining approval from Congress, the United States will raise capital by issuing bonds. Bonds are essentially a form of debt, hence the reason why the ceiling must be continuously raised. The United States treasury bond was initially thought to be a safe investment backed by a top credit rating from S&P and Moody's. As we now know that credit ratings have been downgraded, investing in a U.S. treasury bond has become more risky. Velshi states that the government will become insolvent if the ceiling is not raised by August 2nd, 2011. Republicans favor the proposal to raise the debt ceiling under the condition that several cuts will be made in order to shrink the budget deficit. Federal spending cuts are...