IQRA University (IU) Efficient Markets

Abstracts

"What looks like a small project turns into a big project. What looks like a big project turns into a small project. So I don't think there's been a lot of planning involved. At least in my case, there hasn't been." [Eugene Fama for his work on Efficient Market Hypothesis]

The purpose of this report is to study and analyze that how effective "Efficient Market Hypothesis" can be implemented in capital markets.

This report describes the basic concept of market efficiency and efficient market hypothesis and their implications.

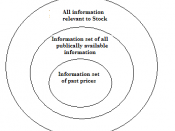

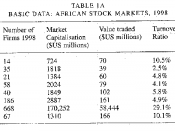

Other parts of report include the, forms of EMH along with their limitation including concept of risk, arbitrage and time value of money in it. Then it comes to the evidence based on the EMH from Ukraine, Africa and than Pakistan, and last session conclude the whole report.

In conclusion some problems with the Pakistan capital markets are identified and that information is gathered through interviews and research articles.

Introduction

One of the most important paradigms in modern finance is efficient market hypothesis and was largely accepted to hold by the early 1970s. "There is no other proposition in the economics which has more solid empirical evidence supporting it" [Michael Jensen]

Market efficiency since then has become the basis of numerous financial models and forms the foundation of the investment strategies of many individuals and corporations.

Much of modern investment theory and practice is predicated on the Efficient Markets Hypothesis (EMH), the idea that markets fully, accurately, and instantaneously incorporate all available information into market prices. Underlying this far-reaching idea is the assumption that market participants are rational economic beings, always acting in their own self-interest and making decisions in an optimal fashion by trading of costs and benefits weighted by the statistically...