William Sharpe, Harry Markowitz and Merton Miller are the three economists who shared a Nobel prize in 1990 for their pioneering work in the theory of financial economics.

Harry Markowitz was awarded the Prize for developing the theory of portfolio

choice; William Sharpe, for his contributions to the theory of price formation for financial assets, the so-called, Capital Asset Pricing Model (CAPM); and Merton Miller, for his fundamental contributions to the theory of corporate finance.

According to Markowitz, the process of selecting a portfolio may be divided into two stages. The first stage starts with the observation and experience ends with belief about the future performance of available securities. The second stage starts with the relevant beliefs about future performances and ends with the choice of portfolio. In our paper, we are concerned with the second stage and will consider the rule stating our portfolio maximizes discounted expect or anticipated return.

We will then look at how our portfolio considers expected return a desirable thing and variance of the return and undesirable thing.

Sharpe Ratio.

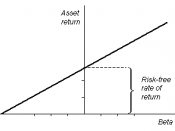

The Sharpe Ratio, named after Nobel Laureate William Sharpe, is the measure of a portfolio's excess return and is measured in relation to the total variability of the portfolio. Sharpe was responsible for the development of the capital asset pricing model. The Sharpe Ratio Equation (2005) is as follows:

After adding all of the securities in our portfolio together, we found that our Sharpe Ratio equated to 2.3. However, this figure is not very informative if we do not have any benchmarks to compare it to, although some economists believe the higher the Sharpe Ratio the better the portfolio but this view has been widely debated.

Treynor Index:

The Treynor index, named after Jack Treynor, relates to the return per unit of risk in a...