1. How is raising money in U.S. stock markets more difficult than in the rest of the world?

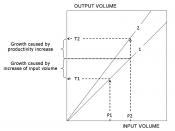

Even if productivity growth has risen, in order to justify the higher dividend growth assumptions necessary to justify the current valuation of the US equity market, one has to assume that, for some reason, return on equity can remain sustainably so high.

On Wall Street, it is indeed fashionable to point to the current high ROE as the explanation for the level of the stock market - this, after all, is what underlies the fashionable Economic Value Added approach to market valuation.

For example, in arguing that the S&P500 was modestly undervalued (by about 8 per cent) comparing to the rest of the world, the Goldman Sachs US Strategy team, Einhorn et al. (1998), assumed that the spread between a company's return on capital (ROC hereafter) and its weighted average cost of capital (WACC hereafter) would be equal to its 1998 level (approximately 4.4

per cent) in perpetuity! This assumption is especially remarkable given that the ROC-WACC spread is, on their own numbers, currently at a record high (for the admittedly short sample of 1986-03). Note that the average value of the ROC-WACC spread over the 1986-03 period is about 1.6 per cent. It is striking that one has to assume that the ROC-WACC spread has to average more than 2 1/2 times its 1986-98 historical average in perpetuity in order to justify current equity market valuations in the US.

However, the presumption that the ROC-WACC spread (or the ROE) can be sustainably high in the US is at variance with both theory and history. Standard considerations of product market competition suggest that any super-normal profits must ultimately be competed away. A strange aspect of the 'new paradigm' view is that...