In the 1920's three pro-business presidents occupied the White House and U.S. businesses appeared to be doing well. The Stock Market was an indicator of this national prosperity. In reality under consumption was a becoming a problem and many products went unsold. Much purchasing was being done on credit and many stock purchases were made "on margin". Another indicator that things weren't as good as they seemed was that bank foreclosures were rising.

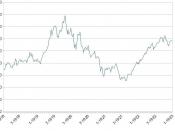

In Mid-September 1929 the market erratically begins to fluctuate up and down. There were a few people who thought that this was just a temporary problem in the market. Economist Irving Fisher was considered an investment prophet. He was recognized for his contributions to technical economic theory, monetary theory. On October 23 A headline in the New York Times has Fisher stating that "Prices of Stocks Are Low and that the market was only shaking out of the lunatic fringe".

He went on to explain why he felt the prices still have not caught up with their real value and should go much higher. Fisher announced in a banker's meeting "security values in most instances were not inflated." Fisher also announced "The nation is marching along a permanently high plateau of prosperity." Little did Fisher know that in the next couple of days his reputation would be crippled forever.

On October 24, 1929 also know as "Black Thursday." the economic bubble finally bursts. On a day of heavy liquidation stock prices fall sharply. Headlines will report the market's paper loss at $5 billion. A pool of bankers act to stem the drop by putting more money into the market, and President Hoover reassures Americans that U.S. business is sound. Within a few days, a headline will read, "Brokers Believe Worst is Over and Recommend Buying of Real...