A fuel tax, also known as a gas tax, is a sales tax imposed on the sale of fuel. In most countries, the fuel tax imposed on fuels which are intended for transportation. Fuels used to power agricultural vehicles, and/or home heating oil which is similar to diesel is taxed at a different, usually lower, rate. The fuel tax is imposed on a federal rate with each state allowing their own subjective amount to this rate.

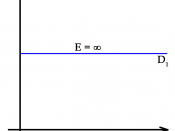

In the United States, the fuel tax receipts are often dedicated to transportation projects so that the fuel tax is considered by many a consumer fee. Because of the relatively inelastic nature of demand for fuel, in the short run the tax will be an effective source of revenue. In the long run, however, the demand may be more elastic, since people adjust their consumption of fuel. Over a period of years, people will consume less as the price increases by switching to more fuel-efficient cars, mass transit, consolidating trips, carpooling, or just traveling less.

However, the demand for fuel is elastic but in the long run the price elasticity of demand may change over time as new technologies and products which are substitutes and/or compliments become available. If consumers drive the same number of miles regardless of gas prices (which appears to be the case in the short run), then the tax on gasoline will be paid for by consumers and not oil companies. Who actually bears the economic burden of the tax is not affected by whether government collects the tax at the pump or directly from oil companies.

Taxes on transportation fuels have been advocated as a way to reduce pollution and the possibility of global warming, conserve energy, and for certain countries reduce dependence on imported oil for foreign policy...