Inflation can be defined as a "sustained increase in the general level of prices in an economy." Like unemployment, inflation is a major issue in economics, closely related to the fluctuating level of economic activity in a region. In Australia, the Reserve Bank of Australia (RBA) attempts to keep the inflation rate in the targeted range of between 2% and 3%.

Economists generally recognise four main causes of inflation: demand, cost, imported and inflationary expectations. In Australia, the average annual rate of inflation in the past 40 years has been at 5.9%, where a good purchased in 1966 for one Australian dollar will now cost ten times as much ($1 $9.94 - measured using the Consumer Price Index (CPI) method).

MEASURING INFLATIONThere are many measures of inflation, depending on which basket of goods and services are used as the basis for comparison. In Australia, the best known and most widely used measure is the Consumer Price Index (CPI).

Consumer Price IndexThe CIP is a statistical time-series measure of a weighted average of prices of a specified set of goods and services purchased by consumers; and therefore reflect changes in the cost of living (thus considered by some a cost-of-living index). The measure allows an evaluation of the inflation in an economy, and includes a basket of products & services such as food, alcohol and tobacco, clothing and footwear, housing, health, transport, communication, recreation and education. Not all goods and services are included, but a wide selection is covered to reflect average household spending patterns and a good indication of the overall movement of prices and in the cost of living.

The inflation rate can be calculated using the following equation:Inflation rate (%)=(Current CPI Index-Previous CPI Index)/(Previous CPI Index) ÃÂ 100/1Similar to New Zealand, Australia's Bureau of Statistics (ABS) calculates and publishes the CPI quarterly (every 3 months).

The table below outlines the 2006 weighting of main expenditure groups in the CPI basket in Australia- source of data: Australia in the Global Economy textbook. Original source: ABS catalogue No 6440.

Expenditure GroupWeighting FactorHousing19.75Food17.72Transportation15.25Recreation12.29Household furnishing, supplies and services8.09Alcohol and tobacco7.41Clothing and footwear5.19Health4.69Miscellaneous4.04Communication2.88Education2.69It can be clearly assumed that the dominant determinants of Australia's inflation are the industries of housing, food, transportation and recreation respectively. This also means that inflation will have significant impact on those sectors of the Australian economy. Australia's CPI is very similar to other developed nations. Below is a table representing the Canadian CPI weighing index on April 2006. Source: Canadian Bureau of Statistics (CBS).

Expenditure GroupWeighting FactorHousing26.75Transportation19.79Food16.89Recreation11.96Household furnishing, supplies and services10.58Clothing and footwear5.37Health4.52Alcohol and tobacco4.13A notable concern in the measurement in Australia's inflation is the exclusion of mortgage interest rates, consumer credit charges and property prices (due to changes implemented in 1998). This has lead to the omission of important changes in the economy such as the enormous increase in residential property prices since the late 1990s.

Another measure of the inflation rate is the underlying rate of inflation, calculated by removing one-off economic impacts. For example, seasonal effects such as higher food prices that are caused by drought or when the RBA tightens its monetary policy by increases in interest rates. This method is used by the Australian Treasury as an important tool for future economic forecasts, crucial for appropriate government intervention in the economy.

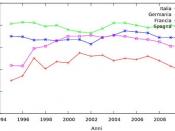

TRENDS IN INFLATION**The graph above compares inflation in Australia and the G7 countries between years 1980 and 2005. A pattern can be identified between both groups, and a major gap is evident in years 1985-1990. Source: www.treasury.gov.auThrough the 1970s and 1980s, Australia experienced substantially high levels of inflation compared to its major trading partners, above all Japan. This is clearly identified in the years 1985-1990 between Australia and G7 nations. After the election of the Hawke Government in 1983, Australia experienced a sudden fall in inflation from 11.4% in March 1983 to nearly 4% in 1984. Many credit the Hawke Government for Australia's current low inflation, though, according to economist David Flint, "the Hawke Government was not such a great reformer." Economists Tim Dixon and John O'Mahony state that "the main development that brought the high inflation era to an end was the recession of the early 1990s." This theory is supported by many other economists including Joshua Gans and Warwick McKibbin.

This pattern was further repeated following this inflationary plunge, where the inflation rate climbed back up to almost 10% in 1986. Inflation then fell to a 27 year low under Paul Keating's Government, reaching under 2% in 1992. Since then, the RBA began to target an inflation rate averaging 2-3% as a guide to determine interest rate decisions. After another growth spike in mid-1992, Prime Minister Paul Keating managed to reduce inflation to a record low of -0.3% in September 1997.

Following the introduction of Goods and Services Tax (GST - a value added tax of 10% on most goods and services) by the Howard Government on July the 1st, 2000, Australia plunged into negative economic growth for the first time in more than 10 years, with inflation rising to a decade high of 6.1% in December.

Inflationary pressures have picked up in the past couple of years, reflecting increased inflationary pressures in the global economy. On June 2006, the RBA recorded an inflation of around 4%, outside its target average of 2-3%. This was blamed to the soaring oil prices, cost of skilled labour and Cyclone Larry, which destroyed most of Australia's banana crop (though, the effects of Cyclone Larry is a controversial topic among Australian economists). According to economists Tim Dixon and John O'Mahony, "inflation rates are expected to drop favourably in 2007".

On May 24, the Organisation for Economic Co-operation and Development (OECD) announced that "Australia's central bank may have to raise interest rates as 'inflationary pressures' build." The organisation also stated that "Australia's annual inflation rate will slow to 2.2 percent this year before picking up to 2.7 percent in 2008, amid the lowest jobless rate in 32 years." Futures traders have priced into the December 30-day interbank contract a 68 percent probability of an interest-rate increase by the year's end. A Credit Suisse index of futures contracts shows traders expect a quarter-point increase in the benchmark interest rate within the next 12 months. By contrast, only eight of 22 economists surveyed by Bloomberg News on May 17 predict a rate increase by March 31 next year. According to a May 17 survey by 'Business Day': "consumers expect inflationary pressures to persist in the economy." According to the Melbourne Institute, "those working as clerks and salesperson registered the highest median expected inflation rate in May," at 6%.

The following is a list of recent expectations by the ABS of inflation in Australian states:Queensland: 6.3%New South Wales: 4.8%Victoria: 4.6%Western Australia:3.6%South Australia: 3.2%Tasmania: undisclosedCAUSES OF INFLATIONDemand-pull inflationDemand inflation arises when aggregate demand in an economy outpaces aggregate supply. It involves an in Gross Domestic Product (GDP) and a in unemployment. This type of inflation occurs as output reaches a point of 'maximum capacity', unable to expand its productive capacity (usually due to low supply of materials or labour). This in turn leads to an in prices as consumers force prices up by bidding against each other for the limited amount of goods and services. The causes to this specific theory are outline by the Keynesian Theory, which states that thethe demand for labour, the employment, and therefore, aggregate demand.

**Source: www.economy.comAs shown above, the cycle begins with a in unemployment, shifting AD1 to AD2, causing an in Y (Y1 - Y2). This in demand means workers are needed, and then AD will be shifted from AD2 to AD3, but this time much is produced than in the previous shift, but the price level has from P2 to P3, a much higher increase in price than in the previous shift. This in price is inflation.

Cost-push inflation**In some countries, imported inflation is a component of cost-push inflation, and therefore included a brief global overview of imported inflation).

costs of production (an imported goods and services in some countries) is the main cause for cost inflation, which is mainly attributed to an increase in money wage rates or an increase in prices of raw materials.

A situation of this was the oil crisis of the 1970s, which some economists see as a major cause of the inflation experienced in the Western world (predominantly the US) in that decade. It is argued that this inflation resulted from increases in the cost of petroleum (a raw material) imposed by The Organization of the Petroleum Exporting Countries (OPEC - An international organization made up of Iraq, Indonesia, Iran, Kuwait, Libya, Angola, Algeria, Nigeria, Qatar, Saudi Arabia, the United Arab Emirates, and Venezuela). Since petroleum is so important to industrialized economies, a large increase in its price can lead to the increase in the price of most products, raising the inflation rate. Countries that have no oil are forced to import it, thus their economy and inflation rates are greatly affected by external stability and foreign relations.

This concept of cost inflation is opposed by economists such as Murray N. Rothbard and Milton Friedman. Those economists believe that an in the cost of goods & services does not lead to inflationary effects without government (and central bank) cooperation in increasing the money supply. The argument states that if the money supply is constant, increases in the cost of a good & service will decrease the money available for other goods & services, and therefore the price of some those goods will fall and offset the rise in price of those goods whose prices have increased.

Source: http://www.drfurfero.com**A in aggregate supply from AS0 to AS1 pushes up prices from P0 to P1 along AD. Cost-push inflation reduces output and increases unemployment.

Imported inflationThis is the main cause of inflation in most developed nations such as Australia, France and Canada. The most obvious cause of imported inflation is an increase of import prices, resulting in an increase in domestic prices. In other words, an in the price of imported goods will result in an in inflation rates in the same way as an in the price of domestically produced goods. In Australia, this type of inflation is transferred to the nation through international transactions.

The importance of imported inflation on a developed economy is presented by International Monetary Fund (IMF) economist James Boughton. In a joint report with economist William Branson, Boughton claims that "commodity prices might serve as a useful leading indicator of inflation in the developed countries." He also notes that "commodity prices were determined in relatively flexible auction markets and as a result tended to respond quite quickly to disturbances, especially monetary ones." An example of this is America's reliance on Canadian oil and China's reliance on Australian minerals.

Inflationary expectationsThis is caused by the population building their expectations into the current behaviour of an economy. The key participants in an economy will have the greatest impact on inflation, as they hold the greatest economical power in any financial system. If they expect an increase in the rate of inflation, they will attempt to protect themselves from it, and therefore create their anticipation.

This poses a tricky problem for the government and the monetary authorities: the problem of disinflation. Once inflation has been going on for a while, and people have inflationary expectations, how should the monetary authority handle the situation?**The following example is by economists Tim Dixon and Jon O'Mahony.

For example, if employers expected further increases in their costs of production, they may raise prices in order to cover the expected increase in costs, resulting in inflation. Similarly, if employees expect a certain level of inflation, they are likely to factor this inflation rate into their wage claims, leading to cost inflation.

The graph below is a simplistic justification of the effects of inflationary expectations.

Source: http://william-king.www.drexel.eduThe following graph shows the inflationary expectations in Australia.

**Source: http://www.budget.gov.au/EFFECTS OF INFLATIONThere is widespread agreement that high and volatile inflation can be damaging both to individual businesses and consumers and also to the economy as a whole.

However, economists disagree about the relative seriousness of inflation.

Most economists agree that an increase in economic growth is a major source of high inflation rates. This effect is triggered by increased consumer demand for goods and services, and demand for higher wages by employees and unions, therefore leading to an increase in prices of goods and services.

Under the Howard Government, Australia sustained relatively low inflation, and therefore a gradual growth in the economy. Though, it failed to reverse the long-term decline in the household saving ratio.

High inflation also discourages business investment as producers are uncertain about future prices and costs, and therefore future levels of profit. On the other hand, low inflation encourages long term investments in productive assets rather than short-term speculative investment which involves higher risks. Though, very low inflation may have negative effects on an economy. For example, since Japan began experiencing such low inflation, the economy began to decline as business investment weakened. According to economist David A. Taylor: "with as much deflation [Japan] has, you almost wonder if the Bank of Japan should let inflation run rampant for a while just so as to let the country catch up from so many years of negative growth."Inflation hurts a countries' standard of living because people have to pay progressively for the same goods and services. If an individual's income doesn't increase at the same rate as inflation, his standard of living will decline even though his wages increase. Also, inflation doesn't impact everything equally, so some goods and services (such as gas prices) can double while others (real estate) may lose value. For this reason, higher inflation will distort consumers' decisions to spend or save disposable income. In conclusion, inflation = spending due to a in their Purchasing Power Parity (PPP) over time.

inflation = employees seek wages (to be compensated for their PPP) = wage-price inflationary spiral (wages = prices = wage demands etc.)In contrast to this effect, low inflation in the 1990s has contributed to much lower wage demands.

Higher rates of inflation tend to negatively affect the inequality between the lower-income earners and the higher income earners. This is because lower-income earners find that their incomes do not rise at the same rapid rate as prices of goods and services, therefore leading to a lower PPP. In addition, they may also face higher interest rates on their borrowings as inflation rises.

Higher rates of inflation also tend to be a disadvantage to individuals on a fixed income as they do not benefit from this growth.

According to economists Tim Dixon and John O'Mahony: "Higher inflation rates can also erode the value of existing savings so that individuals who do not have a means of protecting the impact of inflation will see their net wealth decline."Many modern economists believe that inflation is inversely related to unemployment, especially in the short-term. Periods characterised by high levels of unemployment often also have low inflation rates, and vice-versa. This relationship is shown through the Phillips Curve. The Phillips Curve shows the relationship between a given level of inflation and the expected level of unemployment that would go along with it. As inflation decreases, unemployment is expected to rise. Economists agree that there is a minimum level of unemployment that an economy can handle without causing inflation to accelerate.

In the mid 1970s, Australia experienced simulataneous increases in inflation and unemployment (stagflation). This pattern was contradicted in the 1990s, as Australia experienced lower inflation and lower unemployment.

The graph below compares both rates of unemployment and inflation of Australia and the G7 countries.

**Source: http://www.treasury.gov.au/As inflation rates decrease, a country tends to attract greater foreign investments and increased competitiveness of domestic goods. This should lead to an expansion in exports and the replacement of imports by domestic production, thus improving the trade deficit of a country. In contrast, high inflation often leads to reduced capital inflow in an economy, thus strengthening the nation's currency as sustained low inflation may foster greater international confidence.

Interest rates directly affect the credit market (loans) because higher interest rates make borrowing more costly. As interest rates drop, consumer spending increases and this in turn stimulates economic growth. Contrary to popular belief, excessive economic growth can in fact be very detrimental. At one extreme, an economy that is growing too fast can experience hyperinflation. At the other extreme, an economy with no inflation has essentially stagnated. In Australia, the reduction in inflation during the 1990s led to the lowest nominal interest rates since the 1960s.

GOVERNMENT POLICIES TO CONTROL INFLATIONThe control of inflation has become one of the dominant objectives of government economic policy in Australia. According to most economists, "effective policies to control inflation need to focus on the underlying causes of inflation in the economy." For example, if the main cause is excess demand for goods and services, then government policy should look to reduce the level of aggregate demand. If cost-push inflation is the root cause, production costs need to be controlled for the problem to be reduced.

Since the 1990-1992 recession, and the large fall in inflation, the Australian Government and the RBA have sought to maintain a low level of inflation in the country. Their success has led the economy into a currently high level of confidence "that the low inflation performance of the past decade can be sustained through the effective use of policy mix." - Australia in the Global Economy. According to The Age, this is a principal cause behind John Howard's current popularity as a Prime Minister.

Monetary policy can control the growth of demand through an increase in interest rates and a contraction in the real money supply. For example, in the late 1980s in the UK, interest rates went up to 15% because of the excessive growth in the economy, thus contributing to the recession of the early 1990s (outlined on the graph below).

Source: http://www.tutor2u.netIn Australia, Monetary policy has played a major role in the country's current low inflation rate of 3.5%. If inflation starts rising, the RBA is able to interest rates by tightening monetary policy, thus consumer and investment spending, resulting in a level of economic activity, leading to inflation.

In May 2006, the RBA responded to strong economic growth and concerns about inflationary pressures by increasing interest rates before inflation had become a significant problem. This is known as pre-emptive monetary policy, and is a tool for economist debates and investment opportunities.

Fiscal policies are also used to reduce unemployment. This can be achieved through higher direct taxes, lower government spending and a reduction in yearly government borrowings. These fiscal policies increase the rate of leakages from the circular flow and reduce injections, thus will reduce demand inflation at the cost of slower growth and unemployment.

Australia has also successfully utilized microeconomic reform policies in maintain low inflation. Below is a clear overview of how this is achieved:protection = import prices = domestic competition = difficulty for price increases by domestic producers = thus prices.

According to economists Tim Dixon and John O'Mahony: "the deregulation of the labour market attempts to ensure that wage increases are linked to productivity improvements." Therefore, higher productivity means that the economy will be able to afford real wage increases without inflationary pressures.

âÂÂBibliography:Websites:http://hsc.csu.edu.au/economics/issues/inflation/Topic3Tutorial2Inflati1.html - A brief overview of important aspects of the assessment.

http://www.tutor2u.net/economics/revision-notes/a2-macro-causes-of-inflation.html - An understandable and basic analysis of how to measure inflation.

http://www.rba.gov.au/calculator/calc.go - Allowed me to understand in more detail how inflation is measured, and also enabled me (through their specialised calculator) to calculate the effect of inflation through the past five decades. I was able to put a price in one year, and check how it changed through the years until another given year. Very interesting. It also gave me exact figures of inflation through the years in Australia.

http://en.wikipedia.org/ - A very important source, but was not very specific and did not include all aspects of the assessment. It did give me many good examples of different types of inflation.

http://www.statcan.ca/english/Subjects/Cpi/cpi-en.htm - Gave me trustworthy Canadian statistics to be able to compare is economy with Australia's.

http://www.bloomberg.com/ - Very good articles on inflation.

http://www.rba.gov.au/Statistics/measures_of_cpi.html - The site with all my figures and statistics on Australia's inflation.

http://www.treasury.gov.au/home.asp?ContentID=521 - Government explanations and graphs.

http://www.economy.com/default.asp - Just the source of one graph (shown above).

http://www.drfurfero.com - A point of view of one economist on one section of my assessment.

http://www.cepr.org/ - A very deep analysis of inflation. Very useful.

http://william-king.www.drexel.edu - Included a graph on inflationary effects on an economy.

http://www.budget.gov.au/ - It gave me a graph of the effects of inflationary expectations on Australia's Consumer Price Index (CPI).

http://www.about.com/ - a good outline of inflation.

Books:Australia in the Global Economy by Tim Dixon & John O'Mahony - The base of my research, giving me an overview of each point I need to cover in this assessment.

Newspapers:The Daily Telegraph- Up to date information and issues/opinions, including a summary of the 2006 budget.

Sydney Morning Herald - Up to date information and issues/opinions, including a summary of the 2006 budget.

Media:SBS documentaries - An overview of different sectors in Australia's economy.

ABC news - Gave me up to date information, including the 2007 budget.

People:Luke Maloy - Albury High School teacher - General help.

Bernard Nassif - L'Oreal Manager - Bernard is a very knowledgeable man who gave me a lot of info on Australia's external stability.