In an effort to overcome some of the criticisms and weaknesses of the CAPM, an alternative pricing theory called the arbitrage pricing theory (APT) has been advanced. It was originally developed by Stephen Ross (1976) as 'a related but quite distinct theory' to CAPM of the risk-return relationship.

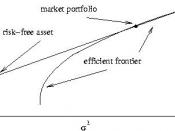

Ross (1976) contended that the APT model is: 'substantially different from the usual mean-variance analysis and constitutes a related but quite distinct theory'. He maintained that APT differs from CAPM in two major ways. First, APT is a multi-factor model while CAPM is a single-factor model. Second, unlike CAPM, the APT model does not require the market portfolio to be mean-variance efficient (i.e. to offer the best risk-return combination) and alternatively assumes that in market equilibrium there will be no arbitrage profits -hence the name 'arbitrage pricing theory'. We will explain each of these distinctions in turn.

The absence of arbitrage

A central feature of the APT model is that it assumes no arbitrage, that is in market equilibrium there are no opportunities to earn arbitrage profits.

Arbitrage is the process of profiting from mispriced securities. Strictly speaking arbitrage involves making a risk-free profit with no outlay. This is in contrast to pure speculation which involves risk-taking, sometimes considerable risk-taking, to make profits.

An arbitrage opportunity occurs where the same security sells for two different prices, usually, but not necessarily, in two different stock markets. Arbitrageurs will buy the security where it is underpriced and sell it where it is priced higher. As a result of arbitrage activity the price will quickly equalise.

Arbitrageurs (or 'arbs') are market traders who make their money from identifying and exploiting market pricing anomalies. Their activities thus help to remove market inefficiencies. Arbitrageurs are different from speculators in that they seek to...