For the purposes of this case analysis of E. & J. Gallo Winery, the wine industry is composed of all alcoholic beverages that contain between eight and twenty percent alcohol by volume. This distinction is based on the assumption that beer and the typical malt liquor contain less than eight percent alcohol by volume. The twenty percent limit is a result of state and federal tax and licensing laws. The three top competitors that are identified in this case study are E. & J. Gallo, Canandaigua and Mogen David.

This industry has seen very limited growth since 1986. Based on Exhibit 4 (C-271, the total wine consumption in the US) and Exhibit 5 (C-271, per capita wine consumption in the US) the wine industry is in the maturity stage. It could even be argued that is entering the decline stage. However, if looking at the last 5 years alone there may still be some potential for growth within the industry.

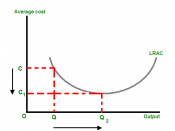

There appeared to be a jump in the growth curve from 1984-88 due to the introduction of wine coolers. There was also another short growth period resulting from the "booming stock market of the 90's and busy lifestyles" that contributed to more wine sales. The bottom line for the wine industry however is that both volume and per capita consumption has stagnated after growing to a peak of nearly 600 million gallons in 1986. This is evidence that the supply has outrun the demand and subsequently the profit margin of winemakers is decreasing. The following table shows the decline in growth rate of the retail value of US wine sales. It also compares the annual percent growth in retail value to the annual percent increase in production.

The next issue to investigate is the importance of technology in this industry.

Essay

Very good essay, clearly explained the E&J Wine strategy and business

0 out of 0 people found this comment useful.