Introduction:

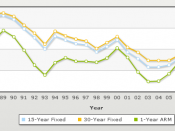

The housing market in the UK is under a lot of pressure because of the fact that the UK economy is under inflation and constantly increasing interest rates on the mortgage. The major factors influencing are inflation, interest rates and the income of the people. Though there are other factors that affect the housing market in the UK they are not as effective as the inflation and the interest rates. The interest rate has gone up in the last few years. According to the bank of England's data an average homeowner is paying ã135 extra towards their mortgage payment compared to last few years which is about 20% higher than two years ago. The increasing interest rates have caused a major crash in the UK's present economy. As per the present situation a middle class family would not be able to afford a mortgage payment if this continues.

As a result of this many people might have to lose their homes. This following essay will try to explain the major factors that determine the housing market in the UK and illustrate the facts and figures of the recent housing market in the UK. (Financial Times)

The factors that are closely related to the crash of housing market in the UK are as follows:

Inflation:

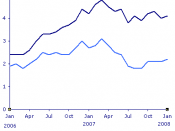

Inflation is defined as a rise in the prices of goods and services, as happens when spending increases relative to the supply of goods on the market. For example, the 2.2% inflation in the UK in Jan, 2008 means that the prices on an average are 2.2 % higher than Jan, 2007. The present inflation in the UK economy is shown below. The consumer prices index inflation in January 2008 is 2.2% has gone up by 0.1% compared to...