A strategy that is aligned to the external and internal environment of an organization will over time enhance the organization's value. It is therefore imperative that organizations develop a good understanding of the business landscape in which they operate before putting together a strategic plan for the business.

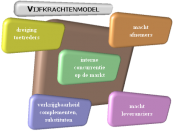

The first step in analyzing the business landscape will be to look at all aspects and stakeholders that play a role in the industry such as barriers of entry, competitors, buyers, possible substitutes etc. This would be followed by an examination of boundaries within which the organization operates.

The company chosen for this report is Sasfin Bank Limited (Sasfin), a specialist bank operating in South Africa's banking sector. The analysis tool used in this report is the Extended Business Model because it captures the evolution of Porter's Five Forces Model and the Value Net Model.

There are a significant number of international financial institutions that do business in this country.

This subjects the players in the industry to severe competitive pressure.

The South African banking industry was not subject to any significant degree of international competition prior to 1994. Post 1994, however has seen the entry of a number of foreign controlled banks and their representatives.

One major factor affecting the power of buyers is relatively high switching costs in the case of SME's whereas the switching costs for high net worth individuals is relatively low.

The South African Reserve Bank (SARB) is the supplier of money to all banks. The SARB has considerable power over the banks. It controls the issuing of banking licenses and therefore has the power to decide who can be in the banking business. All banks have to meet certain regulatory requirements to be in business. The government regulates the banks through the Banks Act 94 of...