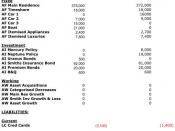

Accounting cycles have multiple steps that must be followed to ensure we are addressing the accounting needs properly. The company I am using is called The Clarksburg Mission, a homeless shelter who buys a lot of supplies to help those in need.

1) Identify a transaction and correctly diagnose the event and produce the source of the document.

Example: A cash purchase was made for $10,000 of supplies. The invoice is received by the accountant.

2) Analyze the transaction and conclude the amount and determine which accounts are going to be changed by this and the direction of the change.

Example: An invoice for the purchase of paper is for $100 on credit. We need to decide which of the accounts are affected: supplies, cash, inventory, accounts payable, etc.

3) Journal Entries, Transactions are recorded in a journal as a credit and debit.

A Journal entry is made under Equipment and cash as well as any other account that is affected.

Example:Debit CreditSupplies10,000Cash10,0004) Posting to ledger. Journal entries are transferred into the suitable T- Accounts. Example: An entry is made to the T-Account for cash.

CASHOctober 15 25,000November 1 10,0005) Trial Balance is the calculation of the sum of credits and the sum of debits, which is made in order to compare them and confirm the results are equal.

Example: The account should verify all the entries and sum up the debits and credits so that they match. Caution must be used is a discrepancy is found with the new entries.

6) Adjusting Entries. Accrued and deferred items should be adjusted, all entries journalized and posted to T-Accounts in the ledger.

Example: If there are any accrued salaries or interests that need to be adjusted, it should be done at this time for preparation of the financial statements.