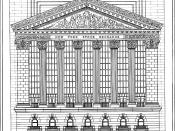

Organized and over-the-counter securities exchanges are similar in that they both deal with the trading of securities such as stocks and bonds. However, they are different in many ways. An organized securities exchange is defined as "A securities marketplace where purchasers and sellers regularly gather to trade securities according to the formal rules adopted by the exchange."(www.trading-glossary.com) On the other hand, a security is traded over-the-counter (OTC) if it trades in some context other than a organized exchange. The New York Stock Exchange and the Nasdaq stock market are two examples of organized securities exchanges.

In an organized market, trading is done in various ways: it may occur on a continuous auction basis, it may involve brokers buying from and selling to dealers in certain types of stock, or it may be conducted through specialists in a particular stock. Some stock exchanges, such as the New York Stock exchange (NYSE), sell seats (the right to trade) to a limited number of members who must meet eligibility requirements.

Stocks must likewise meet and maintain certain requirements or risk being delisted. Stock exchanges differ from country to country in eligibility requirements and in the degree to which the government participates in their management. The London Stock Exchange for example, is an independent institution, free from government regulation. In Europe, members of the exchanges are often appointed by government officials and have semi governmental status. In the U.S., stock exchanges are not directly run by the government but are regulated by law. Technological developments have greatly influenced the nature of trading. In a traditional full-service brokerage, a customer placed an order with a broker or member of a stock exchange, who in turn passed it on to a specialist on the floor of the exchange, who then finished the transaction. Increased access...