In this topic, we will discuss the difference between perfect and imperfect competition, and explain how imperfect competition may have affected the growth and development of the telecommunications sector in Malaysia.

3.1 The difference between perfect and imperfect competition

It is traditional to divide industries into categories according to the degree of competition that exists between the firms within the industry. There are four such categories.

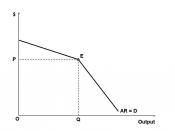

At one extreme is perfect competition, where there are very many firms competing (Sloman J. 2003). Each firm is so small relative to the whole industry that it has no power to influence price. It is a price taker. At the other extreme is monopoly, where there is just one firm in the industry, and hence on competition from within the industry. In the middle come monopolistic competition, which involves quite a lot of firms competing and where is freedom for new firms to enter the industry, and oligopoly, which involves only a few firms and where entry of new firms is restricted.

Imperfect competition means the collective name for monopolistic competition and oligopoly. Table 3.1 shows the differences between the four categories (Sloman J. 2003, p. 149).

Table 3.1 feature of the four market structures (Sloman J. 2003, p. 149).

Type of market Number of firms Freedom of entry Nature of product Implication for demand curve for firm

Perfect competition Very many Unrestricted Homogeneous Horizontal. The firm is a price taker.

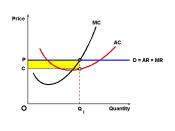

Monopolistic competition Many/several Unrestricted Differentiated Downward sloping, but relatively elastic. The firm has some control over price.

Oligopoly Few Restricted Undifferentiated or differentiated Downward sloping, relatively inelastic but depends on reactions of rivals to a price change.

Monopoly One Restricted or complete blocked Unique Downward sloping, more inelastic than oligopoly, the firm has considerable control over price.

3.2 Which is...