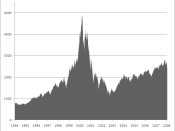

The internet was being thought of as an economy and not a channel in the economy. The events of 2000 signaled the end of the internet bubble and marked the start of a real digital transformation in the economy.

People mainly jumped on the internet bandwagon because of its fashionability. The internet is providing a powerful new business infrastructure, a universal information system for handling the transactions of the economy while bringing about radical new efficiencies to both buyers and sellers of goods and services.

One problem with the dot.com phenomenon was that it was mainly concerned with business-to-consumer retailing. Despite the crash of 2000, the internet still changes everything. Can a business function today without a telephone or fax machine? The Internet too is fundamentally reshaping businesses, the information systems that run them and the industries in which they compete.

In this new economy, gaining market share was considered key because of the benefits of network effects.

In addition, a large customer base was needed to cover the high fixed costs often associated with doing business. Profitability was a second concern, and Netscape was one of the first of many Internet companies to go public without positive earnings. Some companies deliberately operated at losses because it was essential to spend a lot early to gain market share, which would translate at a later point into profitability.

There were dissenting voices, warning that this was just a period of irrational exuberance and the making of a classic stock market bubble. Investors should have paid attention to these voices but instead they chose to buy into the concept as evidenced by the values given to several loss-making dot-com companies.

There tends to be an information gap between investors and companies. Investors usually do not have enough information to determine the good...