BMP Lumber Co.

BMP Lumber Company has been in operation for ten years. During the past several years BMP has experienced significant growth, which its owner, Mr. Paul Grant, believes is likely to continue into the future. This belief has lead Mr. Grant to conclude that BMP requires a bank loan of $80,000 to sustain the business. As financial advisor to Mr. Grant, it is our position that: (a) a loan is required to cover the short-term operating capital needs of the company, (b) Mr. Grant needs to gain control of his current asset accounts, in particular, inventory and accounts receivable, (c) BMP Lumber does not have sufficient fixed assets to secure a loan of the magnitude requested. As a result, we recommend that Mr. Grant either use his accounts receivable and inventory or provide a personal guarantee to secure a loan from the Victoria National Bank ("VNB"). The analysis that leads us to these conclusions is as follows.

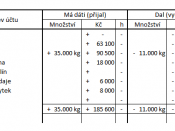

Examination of the pro-forma balance sheet for BMP Lumber for the year 1994 (Exhibit 1 hereto) reveals that, regardless of the sales volume projection ($1.28MM or $1.6MM), BMP will be left with a surplus in their cash account at year-end. However, in the near term, with a trade note of $66,000 coming due, BMP Lumber does not have sufficient liquid assets available to cover this immediate obligation.

An examination of BMP Lumber's quick ratio (Exhibit 6) indicates that the ratio has deteriorated in Q1 1994 compared to 1993 (50% from 63%, respectively). This deterioration can be attributed to an increase in the liability account in Q1 1994. BMP has requested a loan of $80,000, however we do not believe that BMP requires that much money and, if the requested loan of $80,000 were to be approved, BMP's quick ratio...