Companies merging seem like an almost every day situation in the economics world. A merger occurs when one corporation takes over another company. The company that is taken over may remain intact as a division within its parent company or it may lose its identity entirely. Sometimes the companies may merge together to form a entirely new company, depending on the wants and needs of the merger agreement. Mergers are generally classified as horizontal mergers, vertical mergers and conglomerate mergers.

Horizontal mergers occur when two or more companies in the same type of business are brought together under one management. Usually, the reason for such a merger is to reduce competitions and lower prices of competing corporations. Vertical mergers occur when two or more companies who are in different stages of producing the same product come together under one management. For example, a steel company may merge with a iron mine company and steel mills company.

One would participate in a vertical merger in order to reduce costs of producing the companies' products. Conglomerate mergers occur when two or more companies who produce unrelated products or services. Reason for such a merger include using companies to cushion the impact of hard times for one company with the others, gaining entry to a line of business at a lower cost than it would be to start the business fresh, buying a company undervalued by its stock market price, taking advantage of loopholes in tax laws, investing in surplus funds and benefiting from a large company.

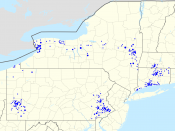

In New York Times on April 11, 2004, there happens to be an article about a merger. The merger involves J.P. Morgan Chase and Bank One Corp., which are two bank corporations. J.P. Morgan Chase which is based in New York and Chicago-based Bank One...