Modern Portfolio Theory: An Overview

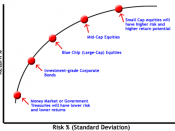

If you were to craft the perfect investment, you would probably want its attributes to include high returns coupled with little risk. The reality, of course, is that this kind of investment is next to impossible to find. Not surprisingly, people spend a lot of time developing methods and strategies that come close to the "perfect investment". But none is as popular, or as compelling, as modern portfolio theory (MPT). Here we look at the basic ideas behind MPT, the pros and cons of the theory, and how MPT affects the management of your portfolio.

The Theory One of the most important and influential economic theories dealing with finance and investment, MPT was developed by Harry Markowitz and published under the title "Portfolio Selection" in the 1952 Journal of Finance. MPT says that it is not enough to look at the expected risk and return of one particular stock.

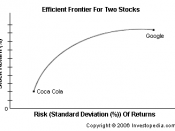

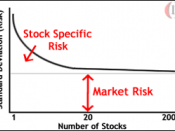

By investing in more than one stock, an investor can reap the benefits of diversification - chief among them, a reduction in the riskiness of the portfolio. MPT quantifies the benefits of diversification, also known as not putting all of your eggs in one basket. For most investors, the risk they take when they buy a stock is that the return will be lower than expected. In other words, it is the deviation from the average return. Each stock has its own standard deviation from the mean, which MPT calls "risk". The risk in a portfolio of diverse individual stocks will be less than the risk inherent in holding any single one of the individual stocks (provided the risks of the various stocks are not directly related). Consider a portfolio that holds two risky stocks: one that pays off when it rains and another that...