Finance 6420

Pressco, Inc.

Statement of Financial Problem.

What is the Net Present Value of the Mechanical Drying Project for Paperco if the following is assumed?

The current tax law does not change.

The project is completed in December 1986.

The time frame is 1985-1996

Financial Framework.

Paperco wants to understand how the business risk of new tax legislations will affect their decision to purchase new equipment. What financial risks to earnings will occur if the investment in new equipment is made?

In capital budgeting there are a number of ways to evaluate projects; each approach has its own advantages. All other things being equal, using IRR and NPV measurements to evaluate projects often result in the same findings. However, using IRR is ineffective in a project with a mixture of multiple positive and negative cash flows therefore using NPV to evaluate this project is the best choice.

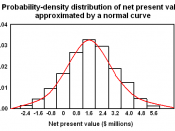

The Net Present Value (NPV) compares the value of a dollar today to the value of that same dollar in the future, taking inflation and returns into account. When deciding between two different projects or many projects the NPV is used to help determine which project will yield the highest value to share holders and how much value can be added to a given company for investing in the project. When evaluating a single project if the NPV is positive it should be accepted. We calculate the NPV by:

Determining the cash out flow or cost of the equipment or project.

Any installations or set up costs should also show as cash out flows.

There may be tax credits that need to be taken into consideration because, in essence, that would be a cash inflow.

Another important factor in calculating the NPV is that tax rate used by the company.