Running head: MICROSOFT STRATEGIC INTIATIVE 1 MICROSOFT STRATEGIC INTIATIVE � PAGE \* MERGEFORMAT �7�

Microsoft Corporation - Strategic Initiative Paper

Ruby Lee, Edward Abaunza, Brian Hammock

University of Phoenix

Finance for Business

FIN 370

Grace Reyes

August 29, 2010

�

�

Microsoft Corporation - Strategic Initiative Paper

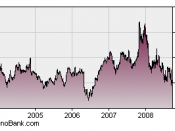

Over the past few years the economy in the United States has taken a downturn. It has been so bad, that some businesses were not able to survive. However, Microsoft Corporation (Microsoft) was not one of those companies. The fiscal strength of Microsoft played a large part in providing the company with the ability and resources to survive the difficult financial markets (Microsoft Corporation, 2009). As a result of the outstanding financial position of the company, Microsoft chose to implement a strategic planning initiative in which the company would repurchase its stock. The $40 billion program would result in increased quarterly dividends and a return to shareholders of close to $14 billion (Microsoft Corporation, 2009).

In this paper, Team B will analyze the stock repurchase initiative of Microsoft. The team will describe the relationship between strategic and financial planning. Further, Team B will describe how the initiative will impact the financial planning of Microsoft, and discuss the impact the initiative will have on costs and sales. Lastly, this paper will describe the risks associated with the stock repurchase initiative and the financial impact these risks may have on Microsoft.

Microsoft's Strategic Planning Initiative

Microsoft's primary strategic planning initiative is to remain prosperous through investments and appropriations. Operating requirements, debt repayment schedules and share repurchases are funded by existing cash, cash equivalents, short-term investments, and funds generated from operations (Microsoft, 2009). Microsoft is always looking ahead and makes sure their balance sheet reflects the need for "potential future capital requirements...